Whether you are at the start of your SMSF education journey, want a better understanding of the essentials of self-managed super funds, or strive to become an SMSF specialist, Smarter SMSF has created a suite of self-paced online courses to help you and your team to grow and maintain your technical SMSF knowledge.

Built and maintained by two of Australia’s leading SMSF specialists, Aaron Dunn, CEO and co-founder of Smarter SMSF, and Tim Miller, SMSF Technical and Education Manager, the courses are fully mobile responsive, allowing you to access the modules to complete via a PC, laptop, tablet or phone.

Aaron Dunn, Course Author

SMSF Specialist Advisor and CPA

CEO and Co-founder, Smarter SMSF

Tim Miller, Course Author

Fellow SMSF Specialist Adviser (FSSA)

SMSF Technical and Education Manager

Complimentary SMSF Association Membership Offer

Students who have completed the nominated Smarter SMSF Course are eligible to claim their complimentary period of SMSF Association membership.*

SMSF Foundations (‘Starter’) Course

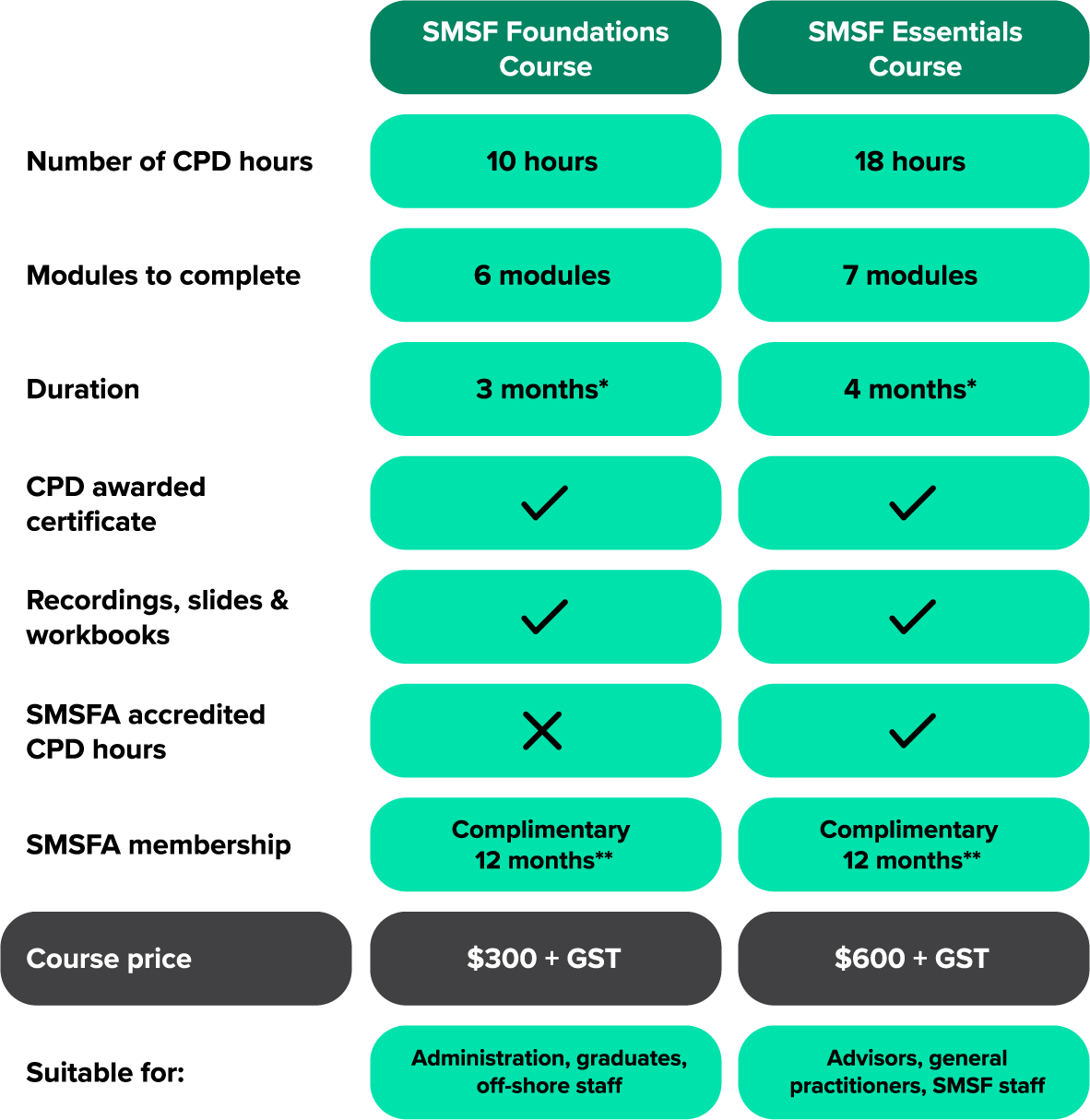

The SMSF foundations course provides you with a fundamental level of knowledge regarding the operation and management of self-managed super funds. The course comprises 6 modules and provides 10 hours of education, designed to suit administration staff, graduates, and off-shore teams.

Students who complete the SMSF foundations course are eligible to claim a complimentary period of Affiliate membership with the SMSF Association*.

SMSF Essentials (‘Smarter’) Course

The SMSF essentials course is designed to help professionals understand what is essential to successfully navigate your way through the ever-changing SMSF technical and regulatory landscape. The course contains 7 interactive modules and provides 18 accredited CPD hours, which can be applied towards your ongoing obligations with the SMSF Association, the major accounting bodies (CPA, CAANZ, IPA), Tax Practitioner’s Board, and other legislated CPD obligations.

The course suits access by general practitioners, intermediate SMSF staff and financial advisers. Students who complete the SMSF foundations course are eligible to claim a complimentary period of Associate membership with the SMSF Association*.

Course Information

*Purchase the Course update add-on feature to provide ongoing updates and access to the Courses for 12 months, beyond your initial duration period ceases.

**Students who complete the SMSF Foundations course and are not current members of the SMSF Association are eligible to claim a complimentary period of SMSF Association membership.

All modules include CPD assessment that must be completed as you work through the various courses.

Course FAQs

Who is this training for?

This training is ideal for:

- Individuals with up to intermediate knowledge of SMSFs (e.g. up to 3 years experience as an SMSF practitioner).

- General practitioners working with SMSF clients – need to update core knowledge on current superannuation and SMSF rules.

- Developing offshore teams.

- CPD training.

This training is NOT ideal for:

- Professionals with ‘specialist’ level knowledge of SMSFs. However, some modules may be advantageous as a refresher (e.g. taxation of SMSFs).

What is included within the purchase of the course?

Each module includes self-paced audio and video-based learning, along with a range of supporting materials, including workbooks within each module, links to important references (e.g. ATO rulings), sample documents provided by Smarter SMSF and other supporting materials.

How do I access this training?

These Smarter SMSF online courses are accessible via the the BGL Learning Channel — an on-demand training platform hosted by BGL Corporate Solutions.

How long do I have access to the online training?

Four months from the date of purchase. You will get access to any changes made to modules throughout this time should you wish to revisit the materials during this time.

How often is the course updated?

The course is regularly reviewed and updates made within a reasonable timeframe following any superannuation and tax laws changes.

If I have a question throughout the course, how do I get help?

You can contact Smarter SMSF at any time throughout the completion of the modules. Contact details are included within each module. Alternatively, you can email Smarter SMSF at [email protected].

When does the CPD certificate get issued?

Immediately after successful completion of all modules and assessments.

Can more than one person within the organisation complete the course?

A CPD certificate is only issued for the registered user that purchases the course.

Who is Smarter SMSF?

Smarter SMSF provides accredited education, training, documents and tools to assist professionals to grow their self managed super fund business. Founded by leading SMSF industry experts, Aaron Dunn and Ian Glenister, Smarter SMSF offers a membership based subscription to access training, technical content, and tools to assist practitioners with SMSF’s.

For more information, visit www.smartersmsf.com.

Who is BGL?

With over 30 years of experience in the software industry, BGL Corporate Solutions (BGL) delivers innovative, multi-award winning company compliance management, self-managed superannuation fund (SMSF) and investment portfolio solutions to over 9,500 businesses in Australia, Hong Kong, New Zealand, Singapore, the United Kingdom and 15 other countries around the world.

For more information, please visit www.bglcorp.com.

© Smarter SMSF Pty Ltd | ABN 40 623 209 021

Changes in circumstances may occur at any time and may impact on the accuracy, reliability or completeness of the information and we exclude liability for any decision taken based on the information shown in or omitted from the course and its materials. Smarter SMSF has taken reasonable care in producing the information found in this course at the time of writing. Current as at December 2023.