Published by Acuity Magazine

Written by Luis Sanchez on 4 February 2019

The latest developments in automation will remove the need for accountants to spend time on repetitive, transactional work, and allow them to make full use of their other skills

IN BRIEF

- Automation can relieve accountants of menial duties such as manual data entry and bank reconciliation.

- The evolving role of the accountant will be to primarily provide services that centre on human input and interaction – such as strategic advisory.

- This shift will allow accountants to focus on building stronger connections with their clients.

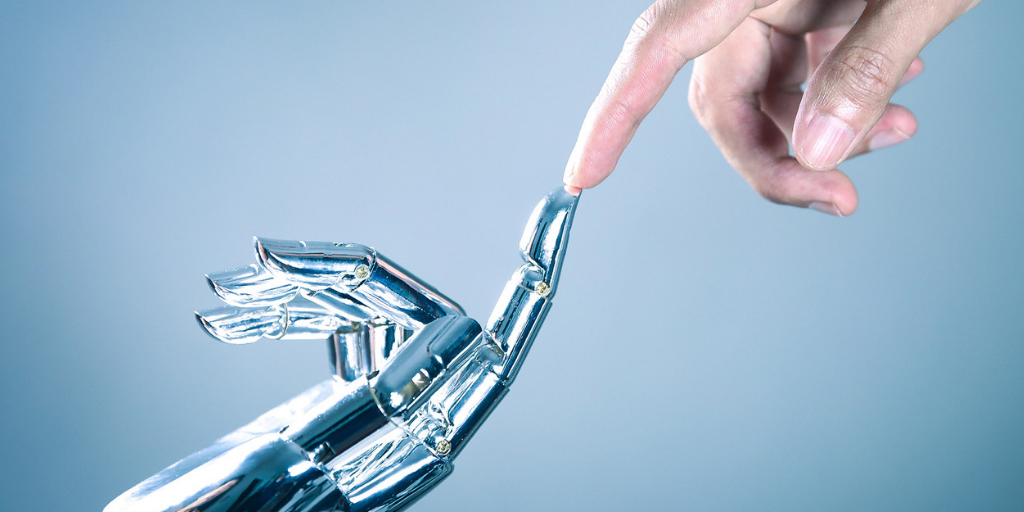

The accountant of the future will bring together the best human qualities and the best qualities of technology. Far from making accountants obsolete, I believe technology is essential to the future of accounting. Automating repetitive tasks such as manual data entry and bank reconciliation will allow accountants to focus on the tasks that require human input and interaction.

Technology is driving change in the industry and it’s likely that manual data entry will soon be a thing of the past. Keying in data from receipts is monotonous work. It’s time-consuming, repetitive, adds no value, and is prone to human error. Automating data entry can save accountants hours each week, as they no longer need to spend evenings or weekends sifting through paperwork.

While we will undoubtedly be guided by technology, business success will increasingly depend on the quality of truly insightful human conversations. We may sometimes underestimate how important conversations are, but in the future they’ll only become more valued.It’s unlikely we’ll ever be able to fully automate an ability to empathise with business owners on the challenges they face, and we all know that the strategic decisions an accountant advises on can either make or break businesses.

We’re already seeing forward-thinking firms use technology to offer more human-focused services. A great example is strategic advisory, which uses personal understanding of goals and aspirations combined with real-time business information. Forward-thinking accountants are spending more time with their clients, and putting more energy into analysing data and offering useful insights, all with a view to helping those businesses succeed.

“The accountant of the future will bring together the best human qualities and the best qualities of technology.”

Data frontiers are also opening up, and creating greater connections between accountants, bookkeepers, small businesses, sole traders, and all of the organisations that serve them. With technologies such as Receipt Bank doing the heavy lifting, data is going to be more accurate and complete than ever. With transactions now primarily happening online, accounting data is generated, stored and tracked digitally, so there will be more scope than ever before to find insights and efficiencies in real time.

At Receipt Bank, we firmly believe that services are going to become increasingly personalised, connected and based on real-time insights. Forward-thinking firms are already changing the business’s relationship with its accountants to a year-long, even life-long connection.

With automation, accountants and bookkeepers will spend less time on low value-add tasks, and more time truly differentiating themselves from the rest and building stronger connections with their clients – and I think that’s exactly what everybody wants to do.

Luis Sanchez – General Manager of the Australian arm of global automated data entry and bookkeeping software company Receipt Bank – considers how automation will transform accounting; the new possibilities in service delivery; and what skills accountants will need to thrive in the future.