BGL is proud to announce its integration with Digital Rapport, an AI-driven reporting platform revolutionising SMSF financial reporting.

“We are excited to welcome Digital Rapport to the BGL Ecosystem,” said BGL’s Chief Executive Officer, Daniel Tramontana. “This integration will help accountants communicate more efficiently and effectively with their SMSF clients. Likewise, it will help trustees better understand their financial data and engage in a meaningful way.”

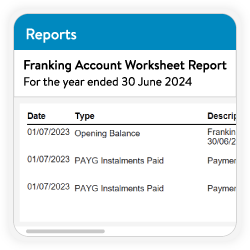

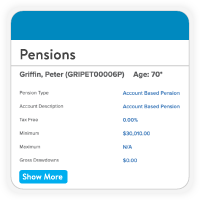

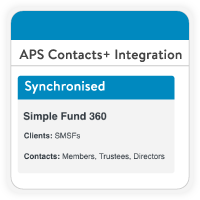

Digital Rapport revolutionises client-accountant communication by creating AI-powered, data-driven videos. This automation enhances engagement with easy to understand visual reporting. The integration connects Digital Rapport with BGL’s award-winning SMSF administration software, Simple Fund 360, via BGL’s free open API.

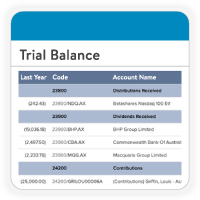

David Cowling, CEO and Founder at Digital Rapport said: “The integration of Digital Rapport with Simple Fund 360 is a game changer for how trustees consume and engage with their financial information. Being an agile and engaging tool, video enhances how accountants report financials to trustees. With seamless data integration, accountants can create a 2-3 minute AI-driven video, narrated in their AI voice, to deliver key highlights of SMSF fund performance. These videos take just minutes to create, are customised with a firm’s unique branding and showcase crucial financial data in a dynamic and easily digestible format.”

Brad Wilkinson, Head of Ecosystem at BGL, said: “This collaboration underscores our commitment to leveraging innovative technologies to enhance the services available to our clients, enabling them to deliver superior service and insights to SMSF trustees”.

Digital Rapport is a proud sponsor of BGL REGTECH 2024, Australia’s premier accounting technology event taking place in Adelaide (14/08), Perth (15/08), Brisbane (21/08), Sydney (22/08), Hobart (27/08) and Melbourne (29/08). Register for free today and visit the Digital Rapport team at their exhibition stand.

Recent Comments