We are excited to announce the latest update for Simple Fund 360 and Simple Invest 360! Click here to check out the full release notes.

Learn what’s new at our New Features Webinar on Tuesday 26 September 2023 at 11:00 AEST. Register Now!

Join the conversation in the new Simple Fund 360 and Simple Invest 360 online communities.

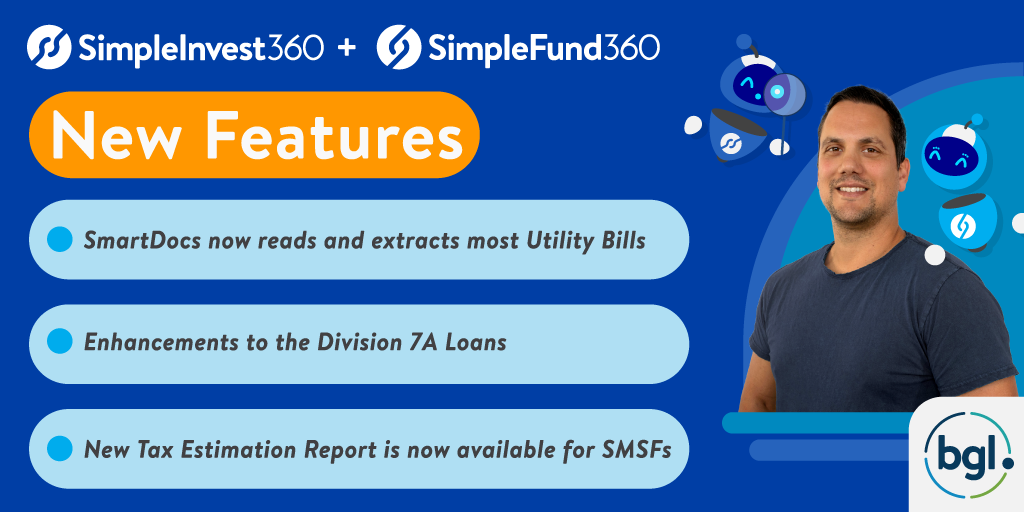

What’s new in Simple Fund 360 and Simple Invest 360

SmartDocs – Utility Bills: BGL SmartDocs can now read and extract data from various utility bills, including water, electricity, solar power, phone and internet. BGL SmartDocs will also extract additional details from utility bills, including supplier information, customer details, and billing periods. Learn More

SmartDocs – Rental Statements: BGL SmartDocs for Rental Statements has been enhanced to increase its accuracy in reading and categorising reimbursed expenses under the appropriate income account. Learn More

Distribution Tax Automation: Improvements have been made to the Distribution Tax Automation including:

-

The document upload screen will automatically close once a document has been successfully uploaded.

-

All investments that have no income and have been fully disposed of during the year will now be included in the main grid.

Merge Field: A new merge field has been added to custom reports to capture all contacts from the ‘Trustee’ Fund relationship for digital signing. Learn More

Actuarial Fee: To record the fee associated with purchasing an Actuarial Certificate, a new 30070 Actuarial Fee expense account has been added to the Chart of Accounts. Learn More

Corporate Actions: The following mergers have been added to Corporate Actions:

-

WebMD Health Corp and Limeade (LME: 10 August 2023)

-

Kirin Health Science Australia Pty Ltd and Blackmores (BKL: 11 August 2023)

-

Elixinol Wellness and TSN (TSN: 18 August 2023)

Exclusive to Simple Fund 360

BGL's complete SMSF administration software

Tax Estimate Report: The Reports screen now includes a new Tax Estimate report that can be generated from 2022 onwards. This report is designed to prepare an estimate for trustees of the Tax Payable or Refundable for the year. Learn More

SuperStream: The Payment Instructions report has been updated, replacing the “Payment Due By [Date]” text field with “Pay As Soon As Possible – Electronic Fund Transfer to be completed by [Date]”. Learn More

Exclusive to Simple Invest 360

BGL's complete accounting, investment and tax software

CAS 360 Integration: When creating a new Trust or Company in Simple Invest 360, the following information will be shared from the firm’s linked CAS 360 software:

-

Entity Details and Addresses

-

Entity Relationships

-

Shareholder/Beneficiary/Unitholder information

-

Shareholder/Unitholder unit transactions Learn More

Division 7A Loans: Several enhancements have been made to manage Division 7A loans.

-

The Interest Received account can now be selected for Loans

-

Post a journal of the dividend declared amount to the Lender’s ledger

-

Post a journal of the interest received amount to the Lender’s ledger

-

The Division 7A worksheet can now be exported to Excel Learn More

Beneficiary Reports: New custom beneficiary accounts have been added to the Beneficiary Balance Summary report.

Plus, many more new features and improvements. Remember to check out the full release notes on the Simple Fund 360 Online Help and join the conversation in the Simple Fund 360 and Simple Invest 360 online communities. Links to previous update release notes are below:

Please reply to this email or contact your Account Manager if you require any further information.

Regards,