BGL proudly announces record-breaking registrations for the upcoming BGL REGTECH 2024 roadshow.

BGL proudly announces record-breaking registrations for the upcoming BGL REGTECH 2024 roadshow.

“We are excited to welcome Digital Rapport to the BGL Ecosystem,” said BGL’s Chief Executive Officer, Daniel Tramontana. “This integration will help accountants communicate more efficiently and effectively with their SMSF clients. Likewise, it will help trustees better understand their financial data and engage in a meaningful way.”

Digital Rapport revolutionises client-accountant communication by creating AI-powered, data-driven videos. This automation enhances engagement with easy to understand visual reporting. The integration connects Digital Rapport with BGL’s award-winning SMSF administration software, Simple Fund 360, via BGL’s free open API.

David Cowling, CEO and Founder at Digital Rapport said: “The integration of Digital Rapport with Simple Fund 360 is a game changer for how trustees consume and engage with their financial information. Being an agile and engaging tool, video enhances how accountants report financials to trustees. With seamless data integration, accountants can create a 2-3 minute AI-driven video, narrated in their AI voice, to deliver key highlights of SMSF fund performance. These videos take just minutes to create, are customised with a firm’s unique branding and showcase crucial financial data in a dynamic and easily digestible format.”

Brad Wilkinson, Head of Ecosystem at BGL, said: “This collaboration underscores our commitment to leveraging innovative technologies to enhance the services available to our clients, enabling them to deliver superior service and insights to SMSF trustees”.

Digital Rapport is a proud sponsor of BGL REGTECH 2024, Australia’s premier accounting technology event taking place in Adelaide (14/08), Perth (15/08), Brisbane (21/08), Sydney (22/08), Hobart (27/08) and Melbourne (29/08). Register for free today and visit the Digital Rapport team at their exhibition stand.

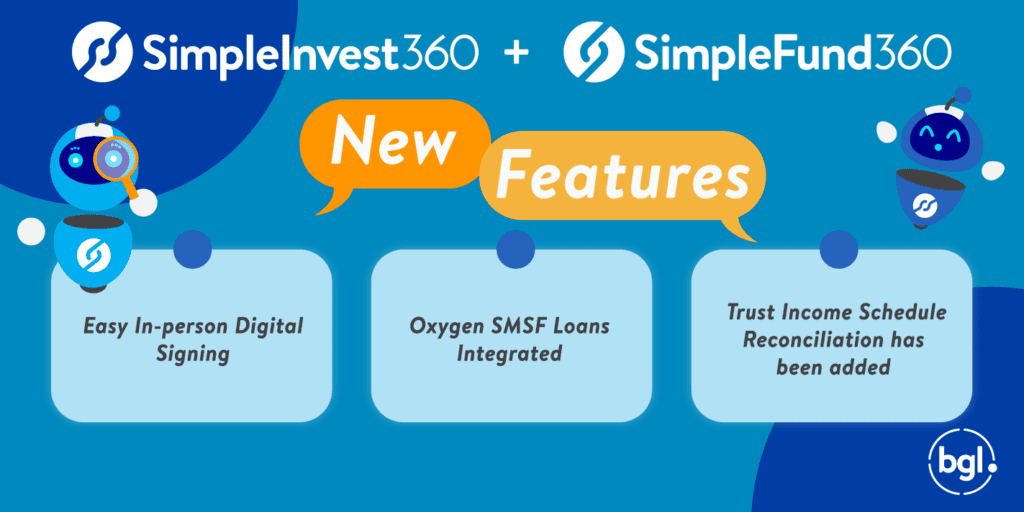

We’re excited to share the latest Simple Fund 360 and Simple Invest 360 updates!

Oxygen SMSF Loans Integration

Oxygen SMSF Loans, a specialist SMSF mortgage lender with some of the lowest-rate SMSF loans in the market, now integrates with Simple Fund 360 via BGL’s open API. This integration provides instant insights into how much a client can afford for property investments. Learn More

2024 SMSF Annual Return

The 2024 SMSF Annual Return can now be exported to Xero Tax via their API. This feature is exclusively available in Simple Fund 360. Learn More

2024 Audit Workpapers

For SMSF Auditors who do not use specialised audit software, Simple Fund 360 enables the printing of prefilled workpaper templates and reports. This feature is exclusively available in Simple Fund 360. Learn More

In-Person Digital Signing

DocuSign’s in-person signing feature is now available. When meeting with a client in person, use in-person signing to simplify the signing process and keep documents digital. This can be done on portable devices like iPads or computers. Learn More

New Report:

Trust Income Schedule Reconciliation report for Trusts and Companies has been added. This feature is exclusively available in Simple Invest 360. Learn More

Reversing Journals

General ledger journal transactions can now be automatically reversed on a future date, with the same accounts but debits and credits reversed. This can be actioned:

This feature is exclusively available in Simple Invest 360. Learn More

Corporate Actions

Improvements to Corporate Actions now allow the processing of Donation or Refunds within Dividend / Distribution Reinvestment Plans (DRP) and Share Purchase Plans. Learn More

BGL SmartDocs

BGL SmartDocs’ AI extraction capabilities have been updated to support a wider variety of dividend statements. Consequently, more dividend files are expected to be automatically attached to cleared transactions upon file upload. Learn More

Plus, many more new features and improvements.

Stay tuned for future releases!

Jeevan Tokhi

General Manager of Product – Simple Fund 360, Simple Invest 360 and BGL SmartDocs 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

This move reflects our collective goal of advancing the accounting sector by making this premier event available to BGL clients, partners and the broader accounting community in these challenging times.

“We are beyond grateful to our sponsors for their outstanding support, which has allowed us to extend an open invitation to all our clients and community to attend BGL REGTECH 2024 at no cost,” said BGL’s Chief Executive Officer, Daniel Tramontana. “We look forward to welcoming everyone to our event of the year and showcasing the amazing developments we have implemented and some we are working on!”

Ron Lesh, Founder/Director of BGL said, “The support from our sponsors has been nothing short of remarkable. Their support is instrumental in making this event available to a broader audience. It underscores our commitment to providing exceptional products and services to our clients, community and the industry.”

Dates and locations:

For more information and to register your team, visit www.bglregtech.com.

We’re excited to share the latest Simple Fund 360 and Simple Invest 360 updates, which include the 2024 Trust and Company Income Tax Returns!

2024 Income Tax Returns: This release supports the 2024 Trust and Company Tax Returns with updates to the PDFs and the Simple Invest 360 user interface.

New ATO Trust Income Schedule: From the 2024 income year, entities receiving 1 or more distributions from trusts (including ETFs, managed funds, and stapled securities) must complete and attach a Trust Income Schedule to the tax return. Simple Invest 360 will automatically populate this as part of the year-end process.

Tax Component Fields: New tax component fields have been added in the following areas:

Previous Year Figures: The option to display the prior year’s tax return detail is now available.

2024 Trust Tax Return: 6 additional Capital Gains labels have been added to the Statement of Distribution section of the tax return. New fields have also been added to accommodate the small business energy incentive.

2024 Company Tax Return: New fields have been added to accommodate the small business energy incentive and digital games tax offset.

The above 2024 Trust and Company tax time updates are exclusively available in Simple Invest 360.

2024 SMSF Annual Return

The ability to export the 2024 SMSF Annual Return to other tax lodgment platforms is now available. Integrated platforms include:

Xero – Read export instructions

LodgeIT – Read export instructions

New and Updated Reports

Plus, many more new features and improvements.

Stay tuned for future releases!

Jeevan Tokhi

General Manager of Product – Simple Fund 360, Simple Invest 360 and BGL SmartDocs 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

As we approach the end of the 2024 financial year, it’s essential that you understand all BGL-recent Simple Fund 360 and Simple Invest 360 updates. This knowledge will help you prepare for tax time and ensure your clients are ready for lodging. The changes outlined below are significant and require your immediate attention.

Changes to SMSF, Trust, and Company Tax Returns will take place on 1 July 2024 as part of the ATO’s Modernisation of Trust Administration Systems (MTAS) project. These changes affect lodgements for the 2023–24 income year onwards and include:

Simple Fund 360 and Simple Invest 360 have been updated to accommodate these changes. Follow the links below for more information:

The good news is that the ATO did not change the 2024 SMSF Annual Return this year.

BGL released an update to Simple Fund 360 on 30 May 2024 to support the new return, including for funds that have been wound up. The new Trust Income Schedule was also included in this release and will affect many SMSFs. Learn More

The SMSF Annual Return can be lodged using Simple Fund 360, or if your firm uses Xero Tax, you can send it directly to Xero for lodgement.

From the 2024 income year, if an SMSF receives one or more distributions from trusts, including (ETFs, Managed Funds, & Stapled Securities), you must complete and attach a Trust Income Schedule to the SMSF Annual Return.

The ATO expects any investment with trust income recorded in the SMSF Annual Return at item 11 Income – labels A, D, M or U2 to complete a Trust Income Schedule. After Creating Entries for the 2024 Financial Year, Simple Fund 360 will automatically create a schedule for each investment that receives a distribution during the financial year. Learn More

The 2024 Trust Tax Return in the Statement of Distribution section has 6 additional Capital Gains labels to match the new Trust Income Schedule. New fields have also been added for the small business energy incentive.

From the 2024 income year, if you received one or more distributions from trusts, you must complete a Trust Income Schedule and attach it to the tax return. This will be automatically populated by Simple Invest 360 as part of the year-end process.

As part of the year-end process, Simple Invest 360 allows you to automatically post inter-entity journals where a group has multiple trusts. This will help avoid data duplication and ensure the accuracy of Tax Components. Learn More

What is Simple Invest 360?

Simple Invest 360 is the complete accounting, investment and tax solution for non-SMSF entities – taking you from bank transaction feed data to tax return lodgement with everything in between! Leveraging BGL’s advanced AI technology, Simple Invest 360 can also automatically extract data from bank statements, rental statements, property settlement statements and annual tax statements to match transactions to the ledger.

A Family Trust Election form can now be created and lodged via Simple Invest 360 for Trusts. Learn More

The 2024 Company Tax Return has new fields to cater to the small business energy incentive and Digital Games tax offset.

From the 2024 income year, if you received one or more distributions from trusts, you must complete a Trust Income Schedule and attach it to the tax return. This will be automatically populated by Simple Invest 360 as part of the year-end process. Learn More

Later this year, BGL will import Due Dates for all entities directly from the ATO and you will be able to lodge Return Not Necessary (RNN) Forms.

Jeevan Tokhi

General Manager of Product – Simple Fund 360, Simple Invest 360 and BGL SmartDocs 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

“This is not your ordinary gathering of accountants but rather a vibrant hub of innovation, inspiration and collaboration for the entire sector” said BGL’s Chief Executive Officer, Daniel Tramontana. “It will be a valuable opportunity for attendees to connect with industry experts and like-minded professionals, where they can explore opportunities in the industry and be ready for the future of technology”.

BGL has invited the five industry professionals to provide an opportunity for attendees to learn from their valuable insights into how to position their businesses for success.

“I am very excited to debut as a speaker for BGL REGTECH 2024“ said Adriana Cavallo, General Manager of Customer Experience (APC) at BGL. “It’s a unique opportunity for all of us to engage directly with the brightest minds in our industry and I look forward to showcasing our cutting-edge technology not only to meet but to exceed client expectations!”

Dates and locations:

For more information and to purchase tickets, visit www.bglregtech.com.

We’re excited to share the latest CAS 360 update! Don’t forget to check out the release notes.

We’re excited to share the latest Simple Fund 360 and Simple Invest 360 updates, which include the 2024 SMSF tax time update!

2024 SMSF Annual Return User Interface and PDFs: The ATO did not change the 2024 SMSF Annual Return. This release supports the new return, including for funds that have been wound up. The new Trust Income Schedule is included in this release.

New ATO Trust Income Schedule: From the 2024 income year, SMSFs receiving 1 or more distributions from trusts (including ETFs, managed funds, and stapled securities) must complete and attach a Trust Income Schedule to the SMSF Annual Return. Learn More

2024 Financial Year Wind-Ups: Wind-ups for the 2024 financial year will now print the 2024 PDF. Learn More

Lodgement Screen Update: The lodgement screen chart has been updated for 2024. Learn More

Digital Signing: Digital signing is now enabled for the 2024 SMSF Annual Return and schedules. Learn More

Fund Transfers: Support has been added for 2024 tax changes related to fund transfers. Learn More

2024 Trust Income Schedule: To accommodate the Trust Income Schedule requirements effective from the 2024 financial year, new tax component fields have been added in the following areas:

The above 2024 SMSF tax time updates are exclusively available in Simple Fund 360.

Mortgage Advice Bureau Integration

Mortgage Advice Bureau (MAB) has been added as an External Service Provider for SMSF lending solutions. Learn More

Opteon Integration

Opteon has been added as an External Service Provider for property valuations, tax depreciation schedules, insurance assessments, rental assessments and quantity surveying. Learn More

Investment Security List

The ability to add an ABN or ACN for a security has been added. This information will be used in the Trust Income Schedule. Learn More

Family Trust Election

A Family Trust Election form can now be prepared and lodged for trusts. Learn More

This feature is exclusively available in Simple Invest 360.

Plus, many more new features and improvements.

Stay tuned for future releases!

Jeevan Tokhi

General Manager of Product – Simple Fund 360, Simple Invest 360 and BGL SmartDocs 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

We pride ourselves on making our clients our top priority and we are excited to announce we have been working on some significant improvements that will make your interactions with BGL faster, easier and seamless.

Here are some of the key enhancements we have implemented so far:

Streamlining Communication: We’re excited to announce the introduction of our new phone system, Dialpad! Dialpad will ensure you reach the right team or team member faster than ever. Dialpad connects you directly to a support consultant, client success consultant or Account Manager without the need for explanations to our Admin Team.

Providing Feedback: To complement our existing ‘Provide Feedback’ function in our cloud software solutions, we’ve added AskNicely to help us create an instant net promoter score. With just a click, you can share your thoughts on our products and services, helping us celebrate the things we are doing well and telling us where we are not so we can work hard to resolve your concerns and issues faster.

Enhancing Your MyBGL Experience: We are working on several improvements to make MyBGL, your online portal for managing your BGL account, better. The first changes will make it simpler for you to register for BGL training and events.

BGL is confident that these enchantments, with many more to come, will make your experience with us more enjoyable and rewarding. As always, we remain committed to providing you with remarkable experiences.

Thank you for your continued support and feedback. We look forward to advising you of more changes to enhance your customer experience with BGL in the coming months.

Adriana Cavallo

General Manager – Customer Experience (APAC)

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

Recent Comments