We’re excited to share the latest Simple Fund 360 and Simple Invest 360 updates!

What's New?

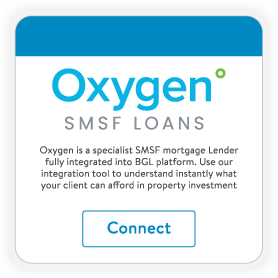

Oxygen SMSF Loans Integration

Oxygen SMSF Loans, a specialist SMSF mortgage lender with some of the lowest-rate SMSF loans in the market, now integrates with Simple Fund 360 via BGL’s open API. This integration provides instant insights into how much a client can afford for property investments. Learn More

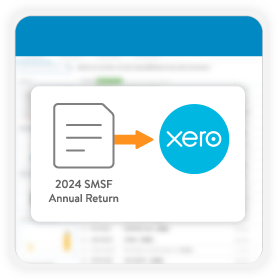

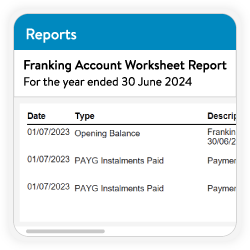

2024 SMSF Annual Return

The 2024 SMSF Annual Return can now be exported to Xero Tax via their API. This feature is exclusively available in Simple Fund 360. Learn More

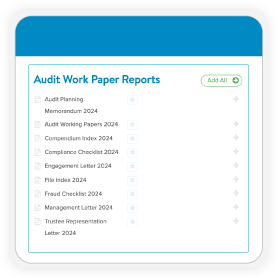

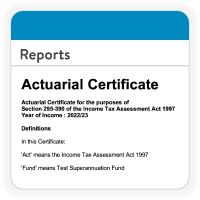

2024 Audit Workpapers

For SMSF Auditors who do not use specialised audit software, Simple Fund 360 enables the printing of prefilled workpaper templates and reports. This feature is exclusively available in Simple Fund 360. Learn More

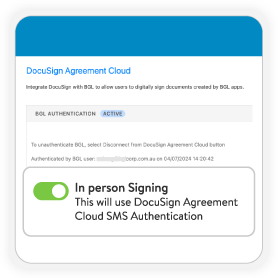

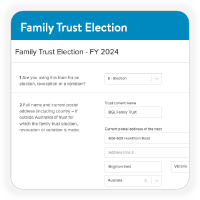

In-Person Digital Signing

DocuSign’s in-person signing feature is now available. When meeting with a client in person, use in-person signing to simplify the signing process and keep documents digital. This can be done on portable devices like iPads or computers. Learn More

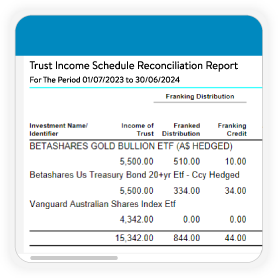

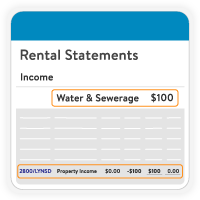

New Report:

Trust Income Schedule Reconciliation report for Trusts and Companies has been added. This feature is exclusively available in Simple Invest 360. Learn More

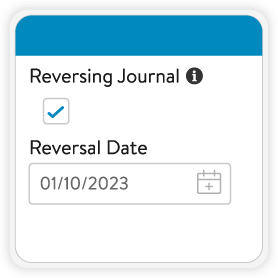

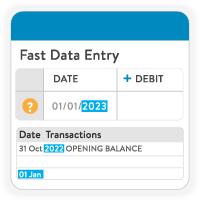

Reversing Journals

General ledger journal transactions can now be automatically reversed on a future date, with the same accounts but debits and credits reversed. This can be actioned:

- At the time of posting the transaction, by including a reversal journal at a future date.

- By editing any general ledger journal transaction and posting a reversal journal at a future date.

This feature is exclusively available in Simple Invest 360. Learn More

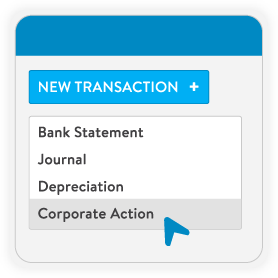

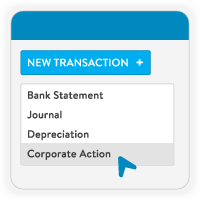

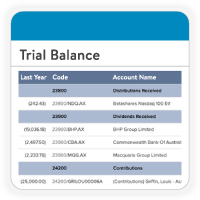

Corporate Actions

Improvements to Corporate Actions now allow the processing of Donation or Refunds within Dividend / Distribution Reinvestment Plans (DRP) and Share Purchase Plans. Learn More

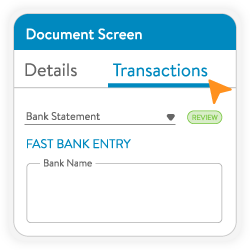

BGL SmartDocs

BGL SmartDocs’ AI extraction capabilities have been updated to support a wider variety of dividend statements. Consequently, more dividend files are expected to be automatically attached to cleared transactions upon file upload. Learn More

Plus, many more new features and improvements.

Stay tuned for future releases!

Jeevan Tokhi

General Manager of Product – Simple Fund 360, Simple Invest 360 and BGL SmartDocs 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

Recent Comments