”In series one, I gave a general overview of how machine learning is adding value to SMSF accounting businesses and what to look for when evaluating machine learning technologies and where it is the best put to use.

This second blog dives into a little more detail as to why machine learning can work well, together with other parts of your cloud-based software. In this case, I’ll share my thoughts on rules (or memorisation-based systems) and how they work together to deliver efficiency.

It is not really a matter of rule-based systems vs AI-based systems. This is a myth perpetuated by those that don’t understand machine learning. The reality is that AI-based systems simply enhance rule-based systems. However, the rules still take precedence where there is ambiguity with a rule or a rule that cannot be created (for example with a once-off special payment) this is where the AI-based system augments the mundane coding process.

BGL performed a detailed research project that found rule-based systems do add a lot of efficiencies. Rule-based systems are particularly good for ASX and wrap based transactions. They are also good for SuperStream-based data. However, they are not so good for direct debits or direct credit-type payments like pension payments, lump sums, rental or transactions that are not clearly identified by rules alone.

Rule-based SMSF systems also become harder to maintain over time as transaction narrations change and evolve. In addition, a purely rule-based system takes longer to set up.

This is where machine learning pattern recognition can offer some advantages. There is no setup time, particularly relevant for newly established or converted funds. The algorithms work where the bank narration is generic or unclear. As more data is processed the ML becomes smarter, as the patterns become even more pronounced. Rules on the other hand need to be maintained or updated when new unseen transactions appear.

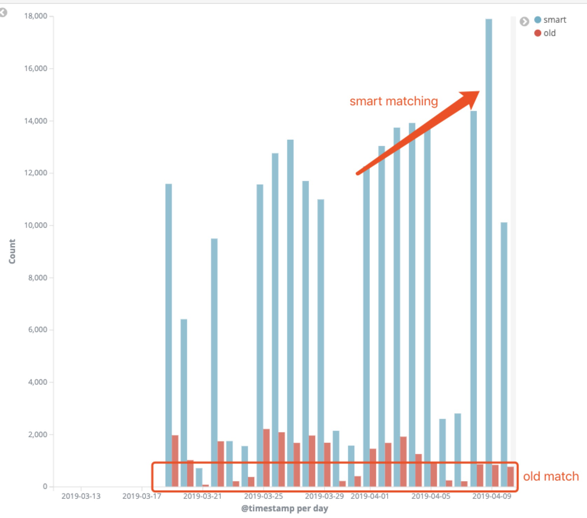

Below is a comparison we performed on the processing of BGL SMSF data sets. The red line indicates our old matching rule-based system and the blue line represents our new AI/ML augmented process called Smart Matching. The height of the line represents the number of transactions processed per day. You can see the blue line in the new smart matching process has been able to categorise more transactions per day than the old rule-based matching system.

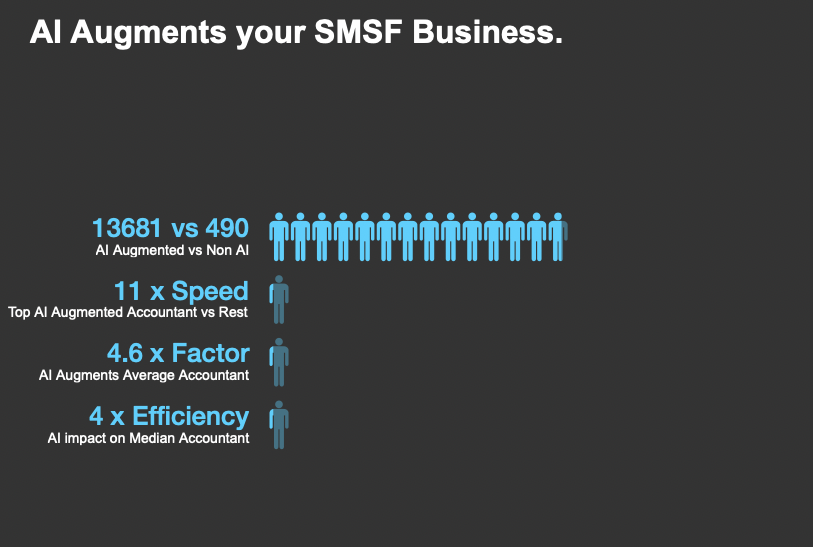

We then broke this data down into clients that utilised the smart matching AI-driven functions and those that did not. Here you can see those who utilised the new Smart Matching capabilities could process the transactions up to 11 times faster on some funds. While the average accounting client could process 4 times.

This significant increase in efficiency can not be entirely attributed to machine learning, as the Smart Matching screen also includes the ability to create rules as well as AI-based coding. What it does show, however, is that a rule-based system together with an augmented AI system can find patterns and make accurate predictions that significantly improve your accounting SMSF-focused business. Most of the time difference comes down to the fact that Smart Matching does predictions and pre-groups the transactions, which helps batch processing and then the remaining predictions can be more easily isolated. Under the old matching system, there is no pre-grouping, the accountant must do this pattern recognition first.

A good analogy would be doing the laundry. Imagine when you do your washing… if you had a machine (New Smart Matching algorithm) to read all the clothes labels (transactions) first and autonomously categorise all your colours, whites and delicates into separated loads. Versus the traditional (old matching) desktop-like process which had all dirty clothes (transactions) all in a big messy pile. You will soon realise the overall time taken to do your laundry reduces.

I hope this can help you to understand a little bit more about the technology that drives the latest cloud accounting technology. Please reach out to me in the comments if you would like to know more about BGL products or services and how they can be of assistance in your Accounting Business.

If you missed part 1, where I explained Artificial Intelligence in terms relevant to accountants and planners, including its relevance to SMSFs and how it can help you with running your SMSF business, click here to check it out >>>

Thank you!