As a part of the new Treasury Laws Amendment (Combating Illegal Phoenixing) Bill 2020 there will be 2 law changes taking effect on February 18 2021.

Ceasing last remaining Director

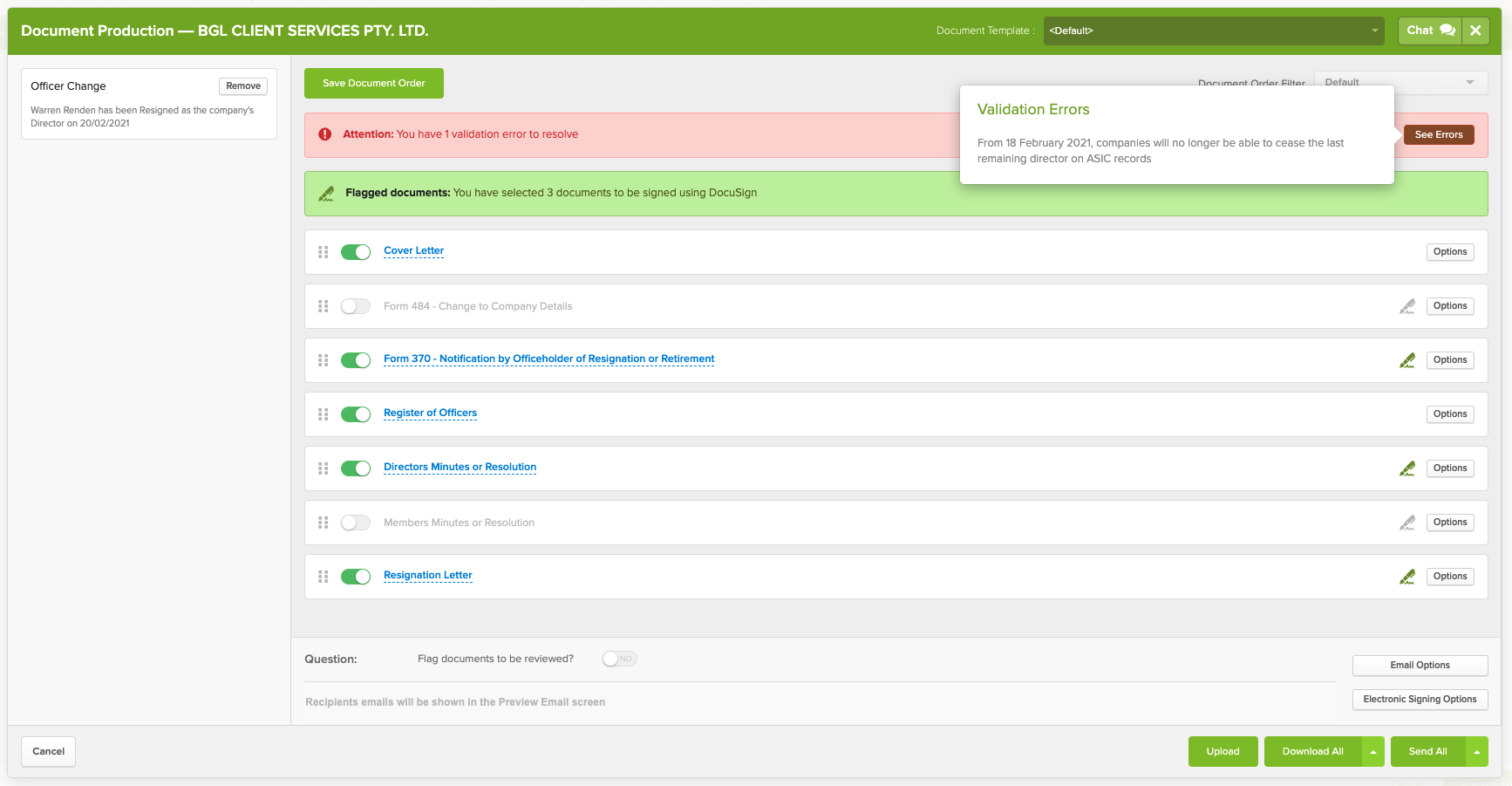

From 18 February 2021, companies will no longer be able to cease the last remaining director on ASIC records.

To enforce this, lodgements submitted using a Form 484 Change to company details, or Form 370 Notification by officeholder of resignation or retirement, to cease the last appointed director without replacing that appointment will be rejected.

There are some exceptions to this, including if:

- the last director is deceased

- the company is being wound up or under external administration; and

- the officeholder never consented to the appointment

Changes that you will see in CAS 360

CAS 360 already had a block on resigning the last remaining director via a form 484, a similar block will be added to the form 370.

We will also add new messaging alerting the users when they are trying to cease the last remaining director.

Director Late Lodgements

There are significant changes for late lodgements of director cessations.

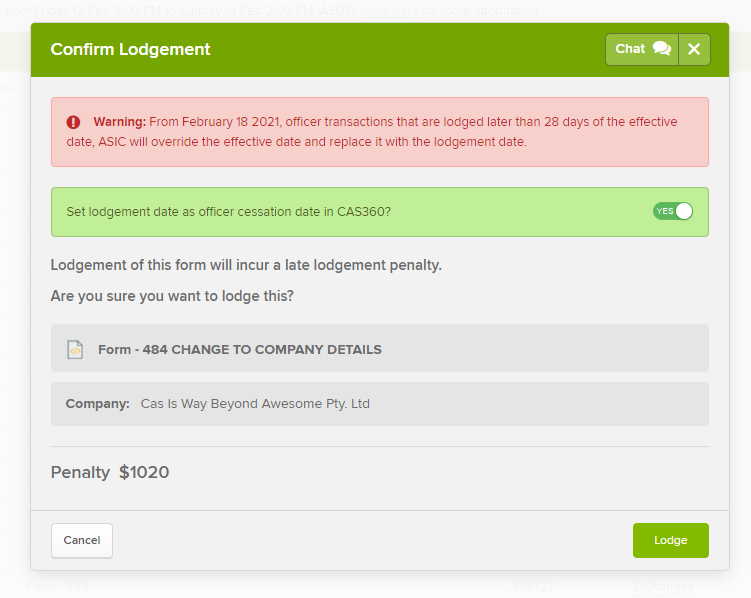

From February 18 2021, if a director’s cessation date is notified to ASIC more than 28 days after the effective date then the effective date will be overridden and replaced with the lodgement date. Late fees still apply to the Change of company details form in this scenario.

Example

John Smith is a director of ABC Industries Pty Ltd.

John Smith resigns as a director on 1 April 2020; however, the Form 484 is lodged to ASIC on 1 November 2020.

On ASIC’s records, the resignation date will be 1 November 2020. The standard late fees will still apply.

Changes that you will see in CAS 360

When lodging a document in CAS 360 that is going to receive a late fee.

CAS 360 will always alert you. A new warning will now appear of officer cessation transactions that are later that 28 days to advise the user that the cessation date will be replaced with the lodgement date.

Recent Comments