We’re excited to share the latest Simple Fund 360 and Simple Invest 360 updates, which include the 2024 Trust and Company Income Tax Returns!

What's New?

2024 SMSF Tax Time Updates

2024 Income Tax Returns: This release supports the 2024 Trust and Company Tax Returns with updates to the PDFs and the Simple Invest 360 user interface.

New ATO Trust Income Schedule: From the 2024 income year, entities receiving 1 or more distributions from trusts (including ETFs, managed funds, and stapled securities) must complete and attach a Trust Income Schedule to the tax return. Simple Invest 360 will automatically populate this as part of the year-end process.

Tax Component Fields: New tax component fields have been added in the following areas:

Previous Year Figures: The option to display the prior year’s tax return detail is now available.

2024 Trust Tax Return: 6 additional Capital Gains labels have been added to the Statement of Distribution section of the tax return. New fields have also been added to accommodate the small business energy incentive.

2024 Company Tax Return: New fields have been added to accommodate the small business energy incentive and digital games tax offset.

The above 2024 Trust and Company tax time updates are exclusively available in Simple Invest 360.

2024 SMSF Annual Return

The ability to export the 2024 SMSF Annual Return to other tax lodgment platforms is now available. Integrated platforms include:

-

Xero – Read export instructions

-

LodgeIT – Read export instructions

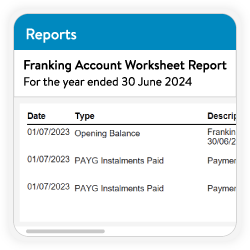

New and Updated Reports

- Fund Snapshot Report for SMSFs (Simple Fund 360 only)

- Trustee Declaration and Notes to Financial Statements (Reporting entities) per the 2024 XYZ Financial Statements (updated)

- Franking Account Worksheet for Companies (Simple Invest 360 only)

Plus, many more new features and improvements.

Stay tuned for future releases!

Jeevan Tokhi

General Manager of Product – Simple Fund 360, Simple Invest 360 and BGL SmartDocs 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

Recent Comments