2020 was a mad year.

I think we are all happy it is behind us.

But, during 2020, I was really proud of what the BGL Team achieved.

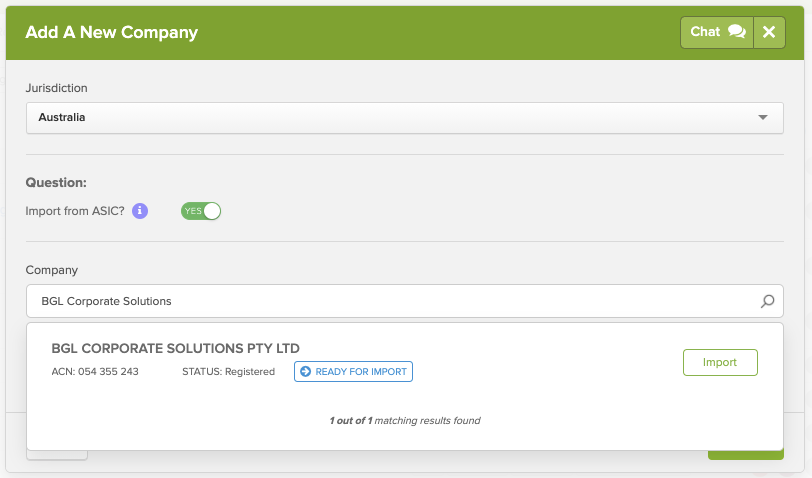

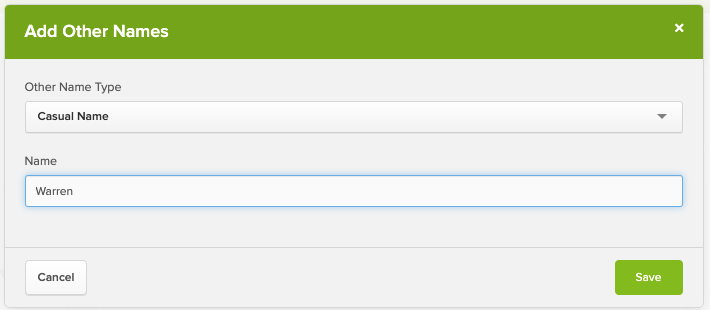

Let me first look at the CAS 360 Team.

There were 17 software releases with over 400 new features released.

Just think about that – 1 software release every 3 weeks and over 1 new feature every day of the year!

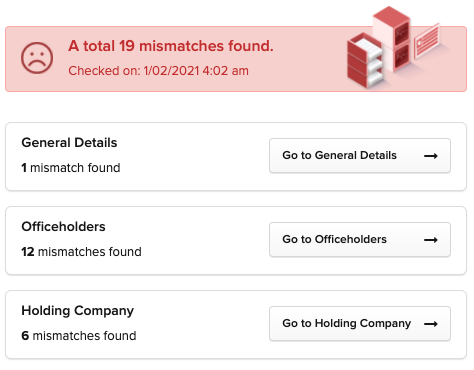

Second, let’s look at Simple Fund 360.

There were 42 major software releases with 100’s of new features released. These include:

- Simple Fund 360 – 15 releases

- Simple Fund 360 Workpapers – 2 release

- Simple Invest 360 – 7 releases

- Simple Fund Mobile – 4 releases

- GuestTrack by BGL – 12 releases

And these are just the major releases!

Apart from the work of these 2 teams, the Training and Documentation Team were tasked with updating the documentation and training materials for both products. These guys did an amazing job keeping up with the speed of development of the CAS 360 and Simple Fund 360 product teams.

And last, but not least, let’s include the fantastic work of the BGL IT Team. The BGL IT Team released myBGL and a huge amount of internal development during the year. This team also made numerous software releases of both myBGL and to other internal systems.

Not a bad effort from 3 of the sensational teams at BGL.

Working from home the Teams proved they are consummate professionals.

I am so proud of what was achieved in a very difficult year. I am so proud of each and every one of you!

Recent Comments