We are excited to announce part 2 of the Tax Time 2023 update for Simple Fund 360 and Simple Invest 360!

We are excited to announce part 2 of the Tax Time 2023 update for Simple Fund 360 and Simple Invest 360!

We are excited to announce the latest CAS 360 update!

New Report: A new ID Verification Status Listing report has been added to the AML Reports section of the Reports screen. This new report displays all individuals in CAS 360, their verification status and the date they were last verified. Learn More

Director Minute/Resolution and Cover Letter: When preparing the ASIC form 489 / 490, users can now quickly add representatives to corporate directors (who do not have one) using the Add Representative(s) option. Learn More

Foreign Companies: ASIC form 405 / 406 will now display the representative name(s) as signatories for corporate directors. Learn More

Independent Trustee: The newly added Independent Trustee relationship position for trusts can now sign trust documents in the same way a Trustee can and as an alternative to the Trustee. Learn More

Public Officer: A new Public Officer relationship position has been added for trusts in CAS 360. The Public Officer position will appear in the People Group report, Individual Compliance report, Contact Relationships screen and Register of Trust Relationships. Learn More

Seal Register Entries: When adding a new Seal Register Entry, CAS 360 will now automatically display the last code used to ensure the same seal code is not used twice for a company. Learn More

Minute Documents: Users can now choose which address to input in the Minute Documents from the Document Options section of the Document Production screen. Learn More

Trusts Relationships Screen: The user interface on the Trusts Relationships screen has been enhanced to create a more seamless user experience. Learn More

Navigation Sidebar: The user interface on the Navigation Sidebar has been improved to adjust to the size of the user’s screen dynamically. Learn More

Plus, many more new features and improvements. Remember to check out the full release notes on the CAS 360 Online Help and join the conversation in the BGL Community. Links to previous update release notes are below:

Stay tuned for future releases!

Warren Renden

Head of CAS 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

Written by Annie Kane

Published by The Adviser on 16 June 2023

Click here to read on The Adviser website

Compare n Save, a fintech platform providing online broking services with traditional fulfilment capability, has partnered with corporate compliance software company BGL Corporate Solutions to help certain clients with loans.

BGL Corporate Solutions currently provides company compliance management, self-managed superannuation fund (SMSF), and investment portfolio solutions to over 9,500 businesses, including major accounting firms, law firms, listed companies, private companies, financial planners, and many individual SMSF trustees.

As part of the integration, the loan comparison company will provide clients of BGL’s Simple Fund 360 (an AI-powered SMSF administration software) and of the investment portfolio management software Simple Invest 360 with a loan comparison solution via the Compare n Save app within their console screen or via the BGL Ecosystem.

Speaking of the integration, Sal Cinque, director of Compare n Save and chief executive of TAG Finance and Loans (a traditional mortgage broking fulfilment business), said that the Compare n Save tech will manage the entire lead-to-settlement journey, including appointment booking, lead tracking, reporting, CRM, online lodgement, and delivery of commercial terms.

“We provide site visitors with a hassle-free service to compare interest rates and special offers. The information is easily accessed, without the need to click through multiple screens or provide contact details before being served the desired information” Mr Cinque, who is also an nMB founding director, said.

“This builds a high level of trust with our visitors and leads to qualified inquiries. When our visitors are ready to proceed, our team of brokers manage the application process.

“In the case of our BGL integration, Compare n Save adds value to over 9,500 businesses in related industries, where advisers can quickly and easily assess potential savings for their clients and engage our fulfilment services.

“We are extremely proud of the BGL partnership. It is a glowing endorsement of our fintech and fulfilment capabilities and further strengthens our relationship with BGL.”

Ron Lesh, BGL’s managing director, commented that he was excited to add Compare n Save to the BGL Ecosystem and offer clients “a hassle-free and simple-to-use loan comparison solution that will add value to their customer service.”

Brad Wilkinson, head of BGL Ecosystem, added: “The BGL and Compare n Save integration will help advisers, accountants, and other BGL clients compare hundreds of loans from more than 30 of Australia’s top banks and other lenders (home, investment, and SMSF loans).

“It will also help clients easily structure debt for property purchases (owner-occupied, investment, and SMSF loans) and conduct regular loan reviews to lower interest costs for their clients. Loans are fulfilled via an experienced broker network, with access to over 500 brokers, nationally.”

We are excited to announce the latest CAS 360 update!

Full Company Register Set: We have added the ability for you to prepare all company registers in one single process. The full Company Register set can be exported for multiple companies at once, and can be customised so that you can include all the company registers that you need for export. Learn more

Succession Director report: We have added a new report for a comprehensive overview of all companies directors, including their respective ages. The Succession Director report provides valuable insights into the approaching retirement of company directors, to facilitate effective succession planning. Learn more

Public Officers relationship (trusts): If a trust carries on a business in Australia or derives income from property in Australia and there is no trustee who is an Australian resident, the trustee generally appoints a public officer. We have added the ability to add a Public Officer relationship to a trust, including the preparation of documents for Public Officers of Australian and New Zealand trusts.

Lodgement confirmation: We have added a lodge document warning message to confirm your intention to lodge a document to ASIC when clicking ‘lodge’ on the notification screen.

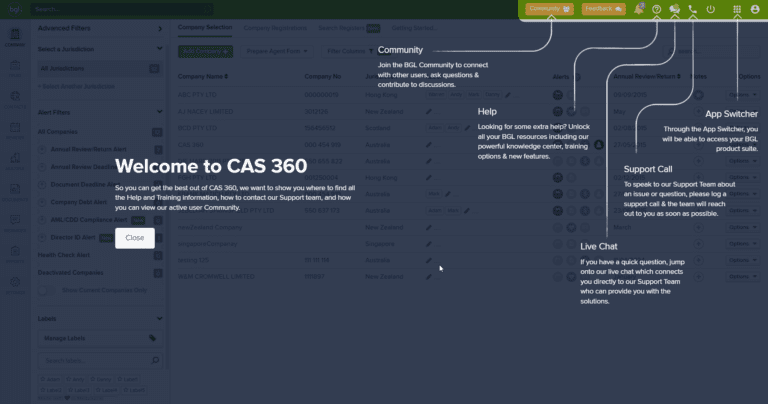

New users walkthrough: We have developed a user-friendly guide that demonstrates all the support materials accessible for new CAS 360 users. Making the new user experience easier and smoother!

Plus, many more new features and improvements. Remember to check out the full release notes on the CAS 360 Online Help and join the conversation in the BGL Community. Links to previous update release notes are below:

Stay tuned for future releases!

Warren Renden

Head of CAS 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

Written by Phillip King and Josh Needs

Published by Accountants Daily on 30 May 2023

Click here to read on the Accountants Daily website

Melbourne fintech start-up Fiduciary Financial Services has launched two digital advice platforms aimed at accountants who lack an AFSL.

Both accountantsGPS, which targets SMSFs, and sister product moneyGPS, which tackles personal finance, allow accountants to supply advice for a subscription fee.

Fiduciary co-founder George Haramis said accountantsGPS was the first digital platform of its kind.

“The digital SMSF check-up report provides a comprehensive analysis of a fund’s compliance and financial situation to evaluate how a fund is progressing in many key areas,” he said.

“The report includes SMSF documentation, investment performance, investment policy development, contribution strategies, investment property performance and debt position, insurance and estate planning.”

“Importantly, it helps trustees and members meet their compliance obligations, as well as their longer-term investment and retirement goals – with access to specialist providers for assistance, if required.”

AccountantsGPS will be joined in July by moneyGPS, which combines AI and human expertise to deliver personal financial advice via an online portal for between $50 to $180 per topic.

“We know that accountants are passionate about the welfare of their clients and now they can offer them accessible and affordable financial advice at a price point that is much more affordable than traditional methods,” Mr Haramis said.

“The moneyGPS service also works alongside any in-house advice service, offering additional support to advisers.”

Mr Haramis said both products operate without commission and provide the ability to share platform insights with clients without a need to be licensed to offer any services within them, the firm also said it rebated the majority of referral fees to the accountant or a charity.

The firm said partnerships for the platforms were in progress as accountantsGPS and its SMSF Check-Up Reports had partnered with BGL Corporate Solutions to make it available as part of their SimpleFund 360 service, and also with Melbourne firm Smarter SMSF.

Published by XU Magazine on 30 May 2023

Click here to read on the XU Magazine website

BGL Corporate Solutions, Australia’s leading provider of company compliance, self-managed superannuation fund (SMSF) and investment portfolio management software, has been recognised as Victorian State Winner of the 2023 Australian Achiever Award with a sensational score of 98.80% for customer satisfaction.

The award included special recognition of Ron Lesh, Daniel Tramontana, Adriana Cavallo, Damien Gunatillake, Luca Ranellone and Peter Di Stefano for their remarkable customer service.

“This is a fantastic achievement and recognition of the BGL Team. I am incredibly proud!” said Ron Lesh, BGL’s Managing Director. “This is the 18th Australian Achiever Award won by BGL and proves again and again our commitment to providing remarkable experiences and sensational customer service to our clients.”

Australian Achiever Awards are an independent award system based on assessments from the business customers. The award system focuses on eight criteria: Time-related Service, Addressing Client Needs, Care and Attention, Value, Attitude, Communication, Overall Perception and Referral. The judging process for 2023’s Australian Achiever Awards for Australia’s Information & Communications Technology Services category was completed on 5 May 2023.

“I am very proud that BGL achieved an impressive customer satisfaction score of 98.80% as well as being named the Victorian State Winner” added Lesh. “As a business, our goal is to provide exceptional service that distinguishes us from others and excites our clients and to be acknowledged for our efforts, most importantly by our clients, is truly wonderful.”

“Congratulations must go to the entire BGL Team on this well-deserved recognition and it was great to see Daniel, Adriana, Damien, Luca, and Peter mentioned in the award presentation. A huge thanks also to all our clients and partners for your continued support. We would not win these awards without all of you!” added Lesh.

The recognition was accompanied by glowing testimonials from our clients, exemplifying BGL’s remarkable customer service.

“The BGL Corporate Solutions team are super friendly and helpful. There is nothing that is too much trouble for them. They are happy to answer any of my questions, even if the answers are obvious. The dealings I have with them feel more like a personal relationship rather than us being a customer. They are the best business that I deal with. I describe Ron, Daniel, Adriana & Damien as my fabulous four.”

“BGL Corporate Solutions are easy to deal with. They understand our needs and what we are looking for. Their program that we use is user-friendly. And they are always happy to help us.”

“They offer us day-to-day support. My business development manager handles my queries. I can call Peter directly; we have open lines of communication. He is efficient in following up and calls back straight away. They are constantly working on their software development and making sure we use the software to optimal effect. And they are always finding solutions for us.

When they come to Sydney, they touch base with us in person. I enjoy their automated customer service, as they reply within twenty-four hours.”

BGL Corporate Solutions (BGL) has announced its integration with Compare n Save, in a move that will help advisers compare hundreds of loans and quickly and easily assess potential savings for their clients and engage BGL’s fulfilment services.

Published by Australian Fintech on 29 May 2023

Click here to read on the Australian Fintech website

BGL Corporate Solutions, Australia’s leading provider of company compliance, self-managed superannuation fund (SMSF) and investment portfolio management software, has been recognised as Victorian State Winner of the 2023 Australian Achiever Award with a sensational score of 98.80% for customer satisfaction.

The award included special recognition of Ron Lesh, Daniel Tramontana, Adriana Cavallo, Damien Gunatillake, Luca Ranellone and Peter Di Stefano for their remarkable customer service.

“This is a fantastic achievement and recognition of the BGL Team. I am incredibly proud!” said Ron Lesh, BGL’s Managing Director. “This is the 18th Australian Achiever Award won by BGL and proves again and again our commitment to providing remarkable experiences and sensational customer service to our clients.”

Australian Achiever Awards are an independent award system based on assessments from the business customers. The award system focuses on eight criteria: Time-related Service, Addressing Client Needs, Care and Attention, Value, Attitude, Communication, Overall Perception and Referral. The judging process for 2023’s Australian Achiever Awards for Australia’s Information & Communications Technology Services category was completed on 5 May 2023.

“I am very proud that BGL achieved an impressive customer satisfaction score of 98.80% as well as being named the Victorian State Winner” added Lesh. “As a business, our goal is to provide exceptional service that distinguishes us from others and excites our clients and to be acknowledged for our efforts, most importantly by our clients, is truly wonderful.”

“Congratulations must go to the entire BGL Team on this well-deserved recognition and it was great to see Daniel, Adriana, Damien, Luca, and Peter mentioned in the award presentation. A huge thanks also to all our clients and partners for your continued support. We would not win these awards without all of you!” added Lesh.

The recognition was accompanied by glowing testimonials from our clients, exemplifying BGL’s remarkable customer service.

“The BGL Corporate Solutions team are super friendly and helpful. There is nothing that is too much trouble for them. They are happy to answer any of my questions, even if the answers are obvious. The dealings I have with them feel more like a personal relationship rather than us being a customer. They are the best business that I deal with. I describe Ron, Daniel, Adriana & Damien as my fabulous four.”

“BGL Corporate Solutions are easy to deal with. They understand our needs and what we are looking for. Their program that we use is user-friendly. And they are always happy to help us.”

“They offer us day-to-day support. My business development manager handles my queries. I can call Peter directly; we have open lines of communication. He is efficient in following up and calls back straight away. They are constantly working on their software development and making sure we use the software to optimal effect. And they are always finding solutions for us.

When they come to Sydney, they touch base with us in person. I enjoy their automated customer service, as they reply within twenty-four hours.”

The award included special recognition of Ron Lesh, Daniel Tramontana, Adriana Cavallo, Damien Gunatillake, Luca Ranellone and Peter Di Stefano for their remarkable customer service.

“This is a fantastic achievement and recognition of the BGL Team. I am incredibly proud!” said Ron Lesh, BGL’s Managing Director. “This is the 18th Australian Achiever Award won by BGL and proves, again and again, our commitment to providing remarkable experiences and sensational customer service to our clients”.

Australian Achiever Awards are an independent award system based on assessments from the business customers. The award system focuses on eight criteria: Time-related Service, Addressing Client Needs, Care and Attention, Value, Attitude, Communication, Overall Perception and Referral. The judging process for 2023’s Australian Achiever Awards for Australia’s Information & Communications Technology Services category was completed on 5 May 2023.

“I am very proud that BGL achieved an impressive customer satisfaction score of 98.80% as well as being named the Victorian State Winner” added Lesh. “As a business, our goal is to provide exceptional service that distinguishes us from others and excites our clients and to be acknowledged for our efforts, most importantly by our clients, is truly wonderful”.

“Congratulations must go to the entire BGL Team on this well-deserved recognition and it was great to see Daniel, Adriana, Damien, Luca, and Peter mentioned in the award presentation. A huge thanks also to all our clients and partners for your continued support. We would not win these awards without all of you!” added Lesh.

The recognition was accompanied by glowing testimonials from our clients, exemplifying BGL’s remarkable customer service.

“The BGL Corporate Solutions team are super friendly and helpful. There is nothing that is too much trouble for them. They are happy to answer any of my questions, even if the answers are obvious. The dealings I have with them feel more like a personal relationship rather than us being a customer. They are the best business that I deal with. I describe Ron, Daniel, Adriana & Damien as my fabulous four.”

“BGL Corporate Solutions are easy to deal with. They understand our needs and what we are looking for. Their program that we use is user-friendly. And they are always happy to help us.”

“They offer us day-to-day support. My business development manager handles my queries. I can call Peter directly; we have open lines of communication. He is efficient in following up and calls back straight away. They are constantly working on their software development and making sure we use the software to optimal effect. And they are always finding solutions for us. When they come to Sydney, they touch base with us in person. I enjoy their automated customer service, as they reply within twenty-four hours.”

Published by XU Magazine on 22 May 2023

Click here to read on the XU Magazine website

BGL Corporate Solutions (BGL), Australia’s leading provider of company compliance, self-managed superannuation fund (SMSF) and investment portfolio management software, is proud to announce the launch of its integration with loan comparison service provider, Compare n Save.

“We are excited to add Compare n Save to the BGL Ecosystem”, said Ron Lesh, BGL’s Managing Director. “This integration will provide BGL’s Simple Fund 360 and Simple Invest 360 clients with a hassle-free and simple loan comparison solution that will add value to their customer service offering.”

Compare n Save is a fintech platform with an ownership stake in TAG Finance and Loans, a traditional mortgage broking fulfilment business. “We are extremely proud of the BGL partnership. It is a glowing endorsement of our fintech and fulfilment capabilities and further strengthens our relationship with BGL”, said Sal Cinque, Director of Compare n Save and CEO of TAG Finance and Loans.

Brad Wilkinson, Head of Ecosystem at BGL, said: “The BGL and Compare n Save integration will help advisors, accountants, and other BGL clients compare hundreds of loans from more than 30 of Australia’s top banks and other lenders for home, investment and SMSFs. It will also help clients easily structure debt for property purchases and conduct regular loan reviews to lower interest costs for their clients. Loans are fulfilled via an experienced broker network with access to over 500 brokers nationally.”

BGL clients can access the Compare n Save app within their Simple Fund 360 and Simple Invest 360 Property Console screen or via the BGL Ecosystem.

BGL’s free and open API is used extensively across the industry. Over 350 data feed and integration partners in the BGL Ecosystem deliver a holistic experience to our clients.

Recent Comments