Well, 2020 is over an out and in my opinion good riddance! So, what lies ahead for the accounting profession in 2021?

Well, 2020 is over an out and in my opinion good riddance! So, what lies ahead for the accounting profession in 2021?

When it comes to the company’s future, BGL is relentlessly customer-centric and will always be focused on improving automation, supporting clients, providing an excellent customer experience, and expanding the BGL Ecosystem.

If 2020 was a lesson in anything, it was to expect the unexpected. Who could have predicted a year of such unprecedented worldwide disruption?

Hello everyone and welcome to 2021!

For the first release of 2021, the CAS 360 team have worked on some great new features.

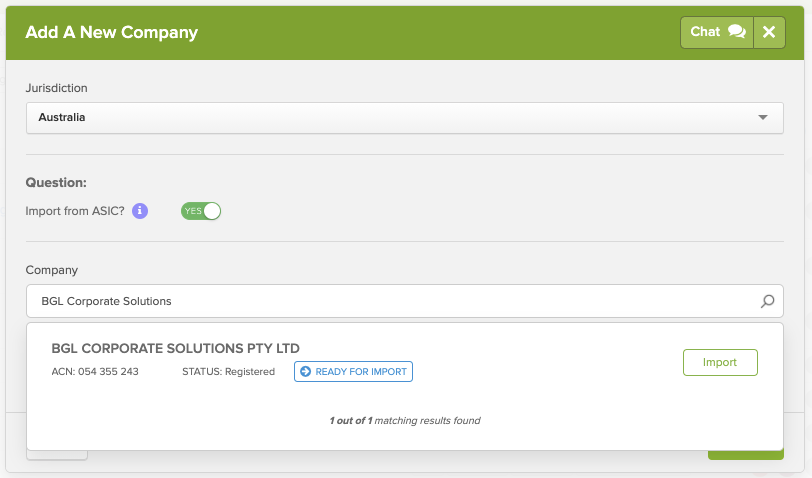

When adding a new company to CAS 360, you can now import the basic company information directly from ASIC.

If you toggle on the ‘Import from ASIC?’ CAS 360 will conduct a real time search of the ASIC register and find the company for you.

Clicking on import, will add the company to your CAS 360 company list, and also import the basic company information (Company Name, Number, Company type and class).

CAS 360 is the best place to manage all of the trusts that your firm looks after, with industry leading trust features.

In this update, we add more documentation for trusts.

When preparing unitholder transactions, if there is an allotment transaction, CAS 360 will now prepare a unit allotment journal, and for unit transfers CA360 will now prepare a unit transfer journal.

New Trust registers have also been added, with a new Register of Trust Relationships, which will show all of the position holders in the trust. Also, a new Register of Trust Events has been added, which will show all event transactions that have taken place inside the trust.

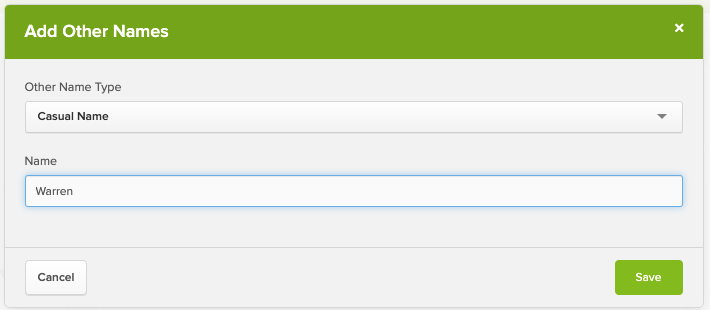

This update sees a huge change in the way contact data is entered into CAS 360. We have added new fields and grouped a number of key data fields.

We have added support for ‘Other Names’ which include ‘Casual Name’ a long time requested feature, soon this casual name will be appearing on documents such as letters.

We have also added a whole heap of new contact fields, including identification numbers, and company number types for company contacts.

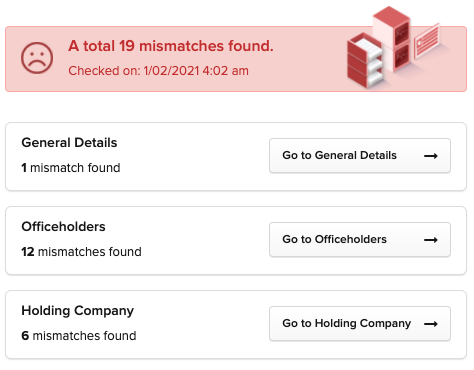

For New Zealand Companies we have expanded the health check to now include General Company Details and Holding company information.

CAS 360 will now check this information every day with the NZ Companies Office and alert you if there have been any changes.

Live Checks (checking when inside the company) has also been added for Company Details and Holding Companies.

If you would like to view the full release notes for February 2021 please click here to visit the BGL Community.

See you next update!

Warren

As a part of the new Treasury Laws Amendment (Combating Illegal Phoenixing) Bill 2020 there will be 2 law changes taking effect on February 18 2021.

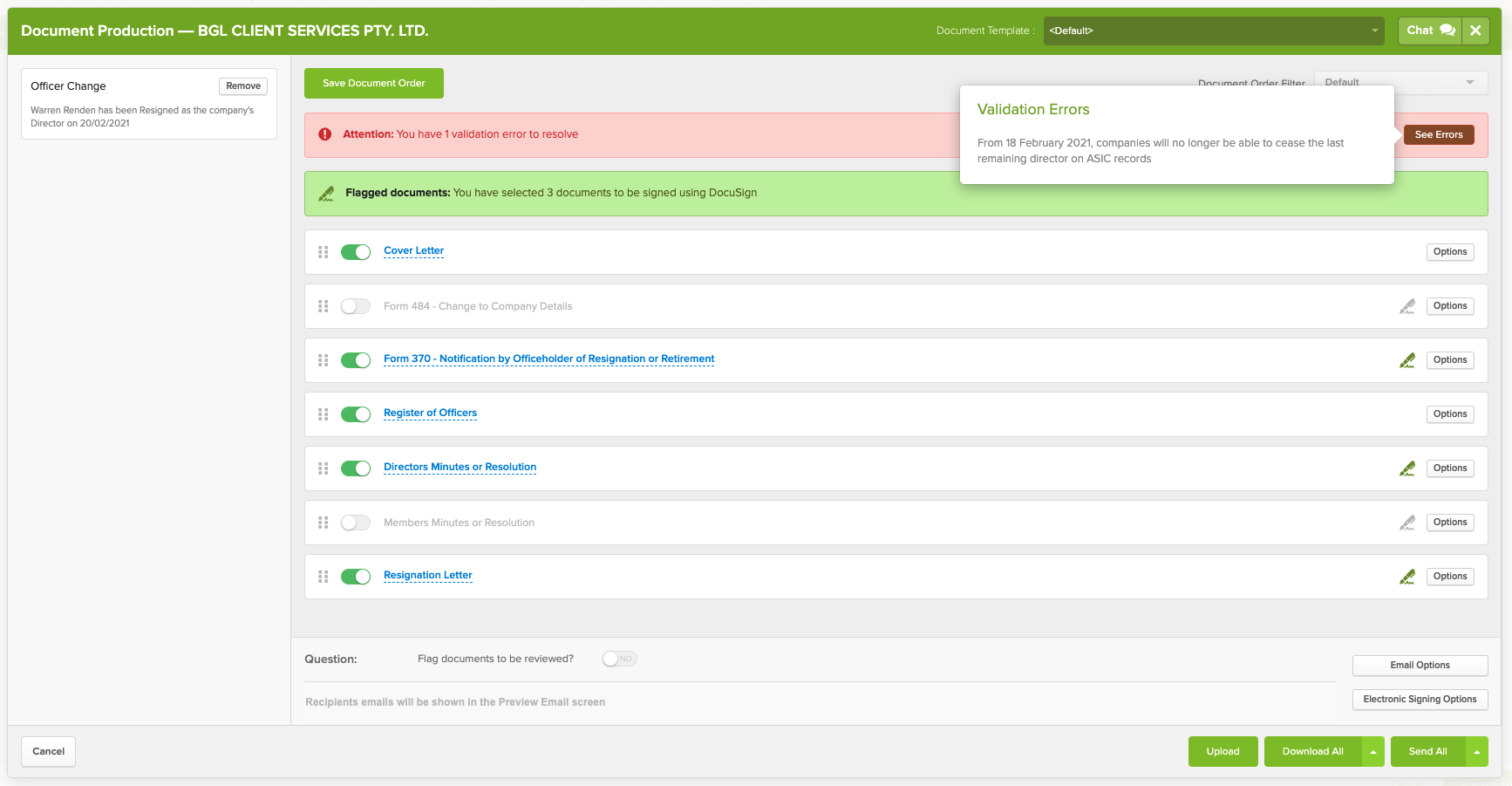

From 18 February 2021, companies will no longer be able to cease the last remaining director on ASIC records.

To enforce this, lodgements submitted using a Form 484 Change to company details, or Form 370 Notification by officeholder of resignation or retirement, to cease the last appointed director without replacing that appointment will be rejected.

There are some exceptions to this, including if:

CAS 360 already had a block on resigning the last remaining director via a form 484, a similar block will be added to the form 370.

We will also add new messaging alerting the users when they are trying to cease the last remaining director.

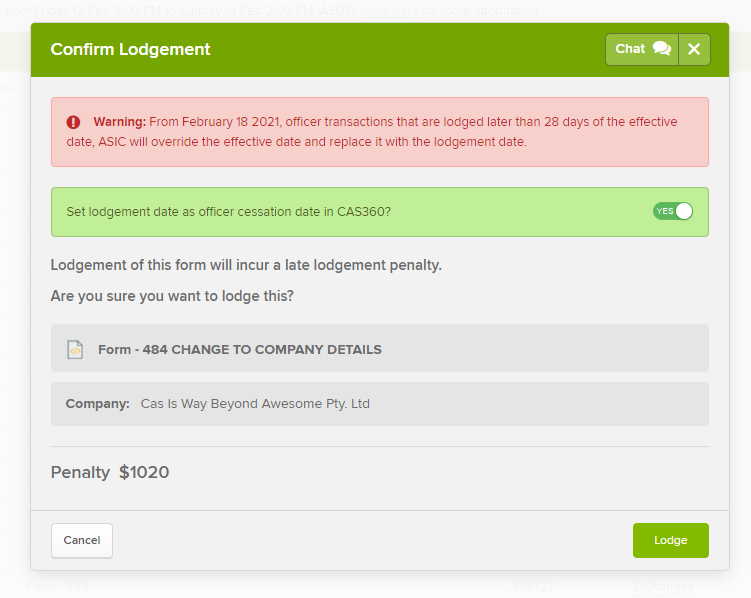

There are significant changes for late lodgements of director cessations.

From February 18 2021, if a director’s cessation date is notified to ASIC more than 28 days after the effective date then the effective date will be overridden and replaced with the lodgement date. Late fees still apply to the Change of company details form in this scenario.

Example

John Smith is a director of ABC Industries Pty Ltd.

John Smith resigns as a director on 1 April 2020; however, the Form 484 is lodged to ASIC on 1 November 2020.

On ASIC’s records, the resignation date will be 1 November 2020. The standard late fees will still apply.

When lodging a document in CAS 360 that is going to receive a late fee.

CAS 360 will always alert you. A new warning will now appear of officer cessation transactions that are later that 28 days to advise the user that the cessation date will be replaced with the lodgement date.

GuestTrack started as an initiative by BGL to help our clients (Accountants) help their clients (Small Businesses) track guests in a COVID-19 environment. As industry leading software developers, GuestTrack was something we released quickly to relieve some stress for our community.

Today, GuestTrack is spectacular market leading guest check-in tool and as we now enter a new normal, we are introducing subscription options so we can recover some of our running costs. These changes come into affect for existing GuestTrack users on Monday 1 February 2021.

All current GuestTrack clients continue to receive a FREE subscription.

| GuestTrack Subscription | Free | Basic | Enterprise | Not-for-profit* |

| Pricing | Free | $9 + GST per month | Contact Us | Free |

| Inclusions | ||||

| Google Ads | ✔️ | ❌ | ❌ | ❌ |

| Unlimited Check-ins/outs | ✔️ | ✔️ | ✔️ | ✔️ |

| Unlimited QR Codes | ✔️ | ✔️ | ✔️ | ✔️ |

| Customisable Form | ✔️ | ✔️ | ✔️ | ✔️ |

| 56 Day Data Retention | ✔️ | ✔️ | ✔️ | ✔️ |

| Email & SMS Notifications | ❌ | ❌ | ✔️ | ❌ |

| Phone, ID & Face Verification | ❌ | ❌ | ✔️ | ❌ |

| CRM, Booking & API Integration | ❌ | ❌ | ✔️ | ❌ |

| AI Analysis & Data Prediction | ❌ | ❌ | ✔️ | ❌ |

* To be eligible for the Not-for-profit GuestTrack Subscription, you must satisfy one of the following requirements: (1) Your registered email ends with .gov.au (2) Your organisation is listed on the ACNC.

Reminder: BGL cannot sell, share or profit from any of the personal data collected by GuestTrack as it is encrypted, and we simply do not have access to it. The data is owned by the GuestTrack account owner (business using GuestTrack) and no one else can decrypt or access this data. GuestTrack Terms and Conditions | Privacy Policy

Welcome our new blog series, which explores some new apps & existing app updates on the BGL block!

“It’s great to see a proper analysis of SMSF cost and return data” said BGL’s Managing Director, Ron Lesh. “And knowing the vast majority of the data came from BGL’s Simple Fund 360 clients makes me even more proud.”

“The report shows the cost of running an SMSF highlighting that larger balance SMSFs cost less to operate than any other type of superannuation fund or account” noted Lesh. “And for smaller balances, SMSFs are comparable with APRA regulated funds”

The report data was sourced from BGL’s Simple Fund 360 and Super Concepts SuperMate software. “It is great to see 2 industry software companies working with Rice Warner to provide the data required to prepare the report at no cost to the SMSFA” added Lesh. “It is unfortunate that not all industry software companies chose to participate”.

“The other data I also found fascinating was the table on Page 21 of the Report showing investment returns for the last 14 years “says Lesh. “From 2005 to 2018, for 9 of the 14 years returns shown in the table, SMSFs performed better than APRA regulated funds”

“Clearly this shows ASIC’s SMSFs are not for everyone flyer was absolute rubbish” stated Lesh. “I said this flyer was misleading and did not fairly represent the cost of running an SMSF. The Rice Warner report validates my statements and furthermore shows that SMSFs with a balance of less than $500,000 are clearly cost competitive with APRA funds dispelling statements made in the December 2018 Productivity Commission report”

Published by SMSF Adviser, powered by MOMENTUM MEDIA

Written by Miranda Brownlee on 19 November 2020

BGL managing director Ron Lesh said the proposal to require SMSFs to prepare their financial statements 45 days before their lodgement date makes no sense and could lead to increased instances of backdating.

“I am trying to understand why this is necessary or where this has come from. It will not improve SMSF reporting, it will not improve SMSF audits, it will not improve SMSF annual return lodgements — so why has it been proposed?” Mr Lesh said.

“In fact, in my view, it could do the opposite. It could put SMSF trustees in a position where they need to backdate accounts — for no reason or benefit.”

Mr Lesh said the SMSF industry has made it clear that the change is unnecessary and that it will simply be an additional burden on SMSF trustees, administrators and auditors.

“I thought post-COVID-19 we were trying to cut unnecessary red tape rather than add more regulations to an already incredibly overregulated industry,” Mr Lesh continued.

“I hope Treasury is listening. A clear statement from Treasury or the government that this change will be dropped is needed now before it causes more angst in the SMSF industry that has already suffered through a year of extreme stress.”

BGL is one of the latest firms to slam the measure, with the accounting bodies and associations such as The Tax Institute and the SMSF Association all expressing concern about the proposed reporting requirement.

“The proposed amendment will achieve nothing beyond forcing the preparation of SMSF accounts into a tighter time frame which will place additional pressure on accountants and those assisting SMSFs in the preparation of their accounts,” The Tax Institute said in its submission.

“Around 99 per cent of SMSFs use a tax agent to lodge their annual return, and tax agents cannot afford to lose 45 days out of their schedule to prepare SMSF accounts earlier in order to meet the proposed requirement.”

Recent Comments