We’re excited to share another exciting Simple Fund 360 and Simple Invest 360 update!

We’re excited to share another exciting Simple Fund 360 and Simple Invest 360 update!

BGL’s Integration with Compare n Save marked a significant advancement for advisors, accountants, and other BGL clients, granting them access to compare…

We’re excited to share another exciting Simple Fund 360 and Simple Invest 360 update! Leveraging generative AI technology with capabilities similar to those found in ChatGPT, the AI assistant will analyse Balance Sheets…

BGL integrates Simple Fund 360 with Australia’s largest SMSF Auditor, ASF Audits, to streamline the audit workflow for SMSFs.

BGL is using generative AI to provide clients with a simple financial analysis of their financial statements in Simple Fund 360 and Simple Invest 360.

We’re excited to share the first Simple Fund 360 and Simple Invest 360 update for 2024!

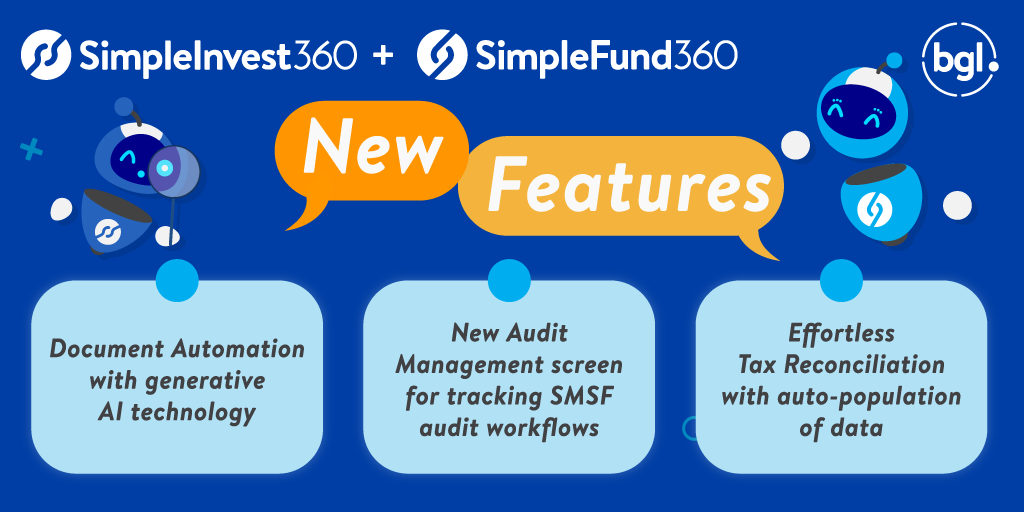

Documents and Workflow

Leverage BGL’s new generative AI technology and integrated Workflow module to automate job creation directly from the Documents screen! This feature works for any document with the AI suggesting the appropriate tasks. Learn More

BGL SmartDocs Email

When an email is received by BGL SmartDocs, its AI technology will evaluate if the email content can be used as accounting documentation, triggering accounting tasks, administration or other workplace-specific activities. If the content meets the criteria, the email is automatically converted to PDF and stored in the Document screen of the specific fund or entity. These PDF emails can also be attached in the Workpapers screen. Learn More

Audit Management screen

Track SMSF audits from start to finish with the new Audit Management screen. Update the audit status and store all documents manually or automatically allowing users to integrate with audit partners and other platforms. Once an audit is complete, easily update the annual return from the same screen. Learn More

This feature is exclusively available in Simple Fund 360.

Workpapers

Save time reconciling 85000 Tax Payable accounts with the new income tax reconciliation table. This feature will automatically populate the current year’s tax payable/refundable and instalment amounts, requiring only manual entry for adjustments to calculate the closing balance. Learn More

This feature is exclusively available in Simple Fund 360.

Workpapers

External document URLs (e.g., Sharepoint, OneDrive, FYI Docs, Dropbox, or Google Drive links) can now be attached in the Working Paper Detail section and Supporting Documents. Users can now also adjust the document order for Working Paper Details and Supporting Documents. Learn More

Workpapers

To view the list of transactions for each account for a Workpaper, the current year transactions can now be viewed within the Workpapers screen. Clicking on a transaction will open the entry in the Transaction screen. Learn More

Pension Commutation Wizard

Transactions posted using the Pension Commutation Wizard now clearly indicate whether they are partial or full commutations. This feature is exclusively available in Simple Fund 360. Learn More

Corporate Actions

10 mergers have been added to Corporate Actions. A warning message will now also be displayed if there is a future disposal or CGT event. Learn More

Reports

The Operating Statement now has the option to combine property expenses. Learn More

Plus, many more new features and improvements.

Stay tuned for future releases!

Jeevan Tokhi

Head of Product – Simple Fund 360, Simple Invest 360 and BGL SmartDocs 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

The BGL Melbourne Office (HQ) will be closed on Friday, 26 January 2024 for the Australia Day Public Holiday. No live software support services will be available on this day.

For BGL cloud software clients, you can find help in the Resources Hub. For BGL Desktop software clients, the BGL Client Centre and BGL Wiki will be available for you as usual.

Please get in touch with us at 1300 654 401 or reply to this email if you require any further information.

“We’re so excited to hit the road and connect with our incredible clients face-to-face,” said BGL’s Chief Executive Officer, Daniel Tramontana. “The BGL Masterclass is an absolute must-attend for BGL CAS 360, Simple Fund 360 and Simple Invest 360 clients seeking a deeper understanding of their software and how they can boost productivity.”

The BGL Masterclasses will be presented by an all-star lineup of BGL experts featuring Andrew Paszko, Simple Invest 360 Product Manager, Jeevan Tokhi, Head of Simple Fund 360 and Warren Renden, General Manager – CAS 360, Ecosystem and Brand.

The event will cover new and key features and their benefits, best practices and processes, essential BGL Suite integrations and time-saving tips, tricks and shortcuts. Plus, attendees will get an exclusive sneak peek at BGL’s product roadmaps.

Warren Renden, General Manager – CAS 360, Ecosystem and Brand at BGL, said, “The BGL Masterclass is not just an event – it’s an interactive and immersive learning experience for our clients. We are beyond excited to showcase our latest features and their benefits, ensuring our clients have the skills and knowledge to unlock the full potential of their BGL software. The purpose of the Masterclasses is to help our clients improve their skills and knowledge. That’s why we offer many learning resources, including the BGL Masterclass and BGL REGTECH events, live and on-demand online product training, webinars, education weeks and more!”

The BGL Masterclass will take place in Adelaide (05/03), Perth (06/03), Sydney (19/03), Brisbane (20/03) and Melbourne (26/03).

For more information and to reserve your place, visit www.bglcorp.com/bglmasterclass.

We are excited to announce the latest update for Simple Fund 360 and Simple Invest 360. Click here to check out the full release notes.

Join Jeevan Tokhi, Head of Simple Fund 360, and special guest Aaron Dunn, CEO and Co-founder of Smarter SMSF, for a webinar on Tuesday 19 December 2023 at 11:00 AEDT, as we highlight the most exciting feature releases of 2023. Register Now!

Join the conversation in the Simple Fund 360 and Simple Invest 360 online communities.

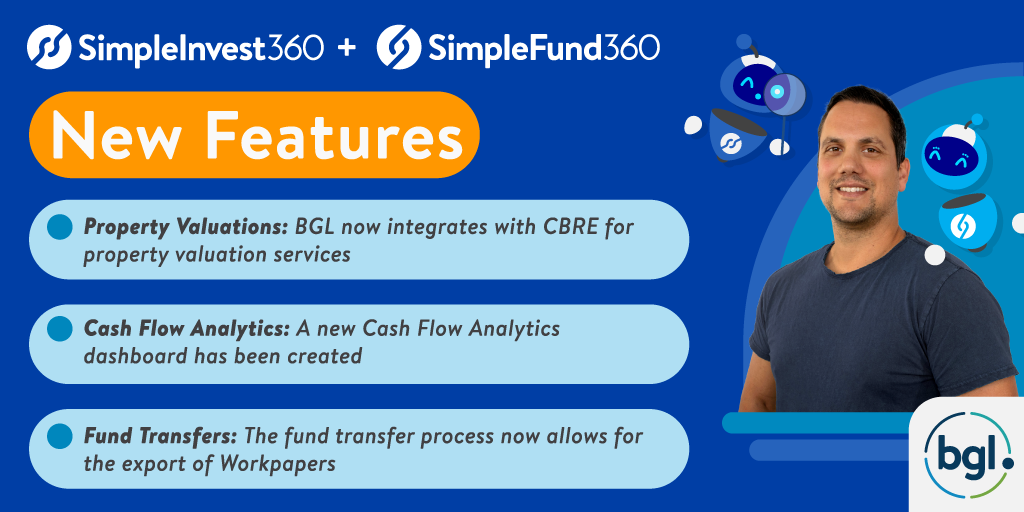

Property Dashboard: BGL now integrates with CBRE to provide clients with seamless access to property valuation services that meet SMSF audit requirements across residential, commercial and agribusiness assets. Learn More

Cash Flow Analytics: A new analytics dashboard has been created to display bank balances versus minimum/maximum targets, cash in/out by month and cash flow from investment income for SMSFs, trusts and companies. Learn More

Custom Reports: Custom Reports now support 3 new mail merge fields for Business Activity Statements (BAS) and Instalment Activity Statements (IAS):

Corporate Actions: The following ASX mergers have been added to Corporate Actions:

Workpapers: An N/A option has been added to all the standard checklists in Accounting Workpapers. This is ideal for items not required to be checked for the entity. Learn More

Workflow: The Entities screen now supports sorting by entity code and filtering by multiple labels. Also, changing the status of a Job to Complete will now automatically complete all tasks for that job. Learn More

Fund Transfers: The fund transfer process now allows for the export of Workpapers. This is optional and can be turned off if required. Learn More

Plus, many more new features and improvements. Remember to check out the full release notes in the Simple Fund 360 / Simple Invest 360 Online Help and join the conversation in the Simple Fund 360 and Simple Invest 360 online communities. Links to previous update release notes are below:

Stay tuned for future releases!

Jeevan Tokhi

Head of Simple Fund 360

E: [email protected] | P: 1300 654 401

Connect with me on LinkedIn

”If you have trusts, companies, and individuals with complex/detailed investment transactions, Simple Invest 360 is the product to use, and the amount of time saved ensures you won’t be disappointed.

Lighthouse Super Solutions, founded in 2008, is a leading provider of self-managed superannuation fund (SMSF) administration services in Australia. With a commitment to delivering independent, accurate, and comprehensive SMSF solutions, Lighthouse Super Solutions enables trustees to simplify their reporting and statutory obligations, allowing them to focus on effectively managing their SMSF. Based in Sydney, the firm serves clients across all states and territories.

Before adopting Simple Invest 360, Lighthouse Super encountered significant challenges in managing their clients’ capital gains tax (CGT) records and tax components of distributions, particularly for non-SMSF entities. Damian described this as a “challenging and manual process”, often reliant on spreadsheets. The firm required a more efficient and accurate solution to handle these complex financial investments and tax-related tasks.

Seeking a solution to address the firm’s challenges and streamline their workflow, Damian and his team turned to Simple Invest 360. Long-time user of BGL products, including Simple Fund 360, Damian had confidence that Simple Invest 360 would be a valuable addition to their business. He recognised that existing accounting programs needed help to accurately account for complex financial investments, CGT reporting, and dividend/distribution income reconciliations. Simple Invest 360 presented itself as a natural progression to meet these needs.

Since implementing Simple Invest 360, Lighthouse Super has experienced a great transformation in their SMSF administration processes. Simple Invest 360 invaluable key aspects and benefits include:

The adoption of Simple Invest 360 has delivered significant benefits to Lighthouse Super, including:

In comparison to other solutions Lighthouse Super used, Damian specifically highlighted the unparalleled automation provided by Simple Invest 360, particularly in terms of data feeds.

Damian’s advice to other businesses considering Simple Invest 360 is clear: “If you have trusts, companies, and individuals with complex/detailed investment transactions, it is the product to use, and the amount of time saved ensures you won’t be disappointed.” Simple Invest 360 has met and exceeded Lighthouse Super’s expectations, delivering a powerful solution for SMSF administration that has made a meaningful impact on their operations and client satisfaction.

Damian Grech, a Fellow of CPA Australia, has had a distinguished career in accounting and financial services. He began as a cadet accountant and gained expertise in various areas, including business services, taxation, auditing, and superannuation. Damian’s passion for self-managed superannuation funds (SMSFs) led him to become an SMSF Specialist Advisor™ accredited with the SMSF Association. He currently heads the administration, compliance, and advice division of Lighthouse Super Solutions, providing clients across Australia with technical assistance on a range of SMSF matters.

Recent Comments