Browsing through various platforms, it has been great to see the discussions around digital signing.

Digital signing in my view, is a must for any organisation where client signatures are required and where the law permits.

As a software provider, it is important to build into the software design and experience a quality engagement piece that brings to surface the true value of Digital Signing.

At BGL Corporate Solutions, we currently integrate CAS 360 (Australia), CAS 360 (New Zealand), Simple Fund 360 and Simple Invest 360 with DocuSign and Adobe Sign and soon to be released, FuseSign by FuseWorks and PleaseSign.

What differentiates these integrations is that they are built directly into the software.

Well, what does this mean? Simple.

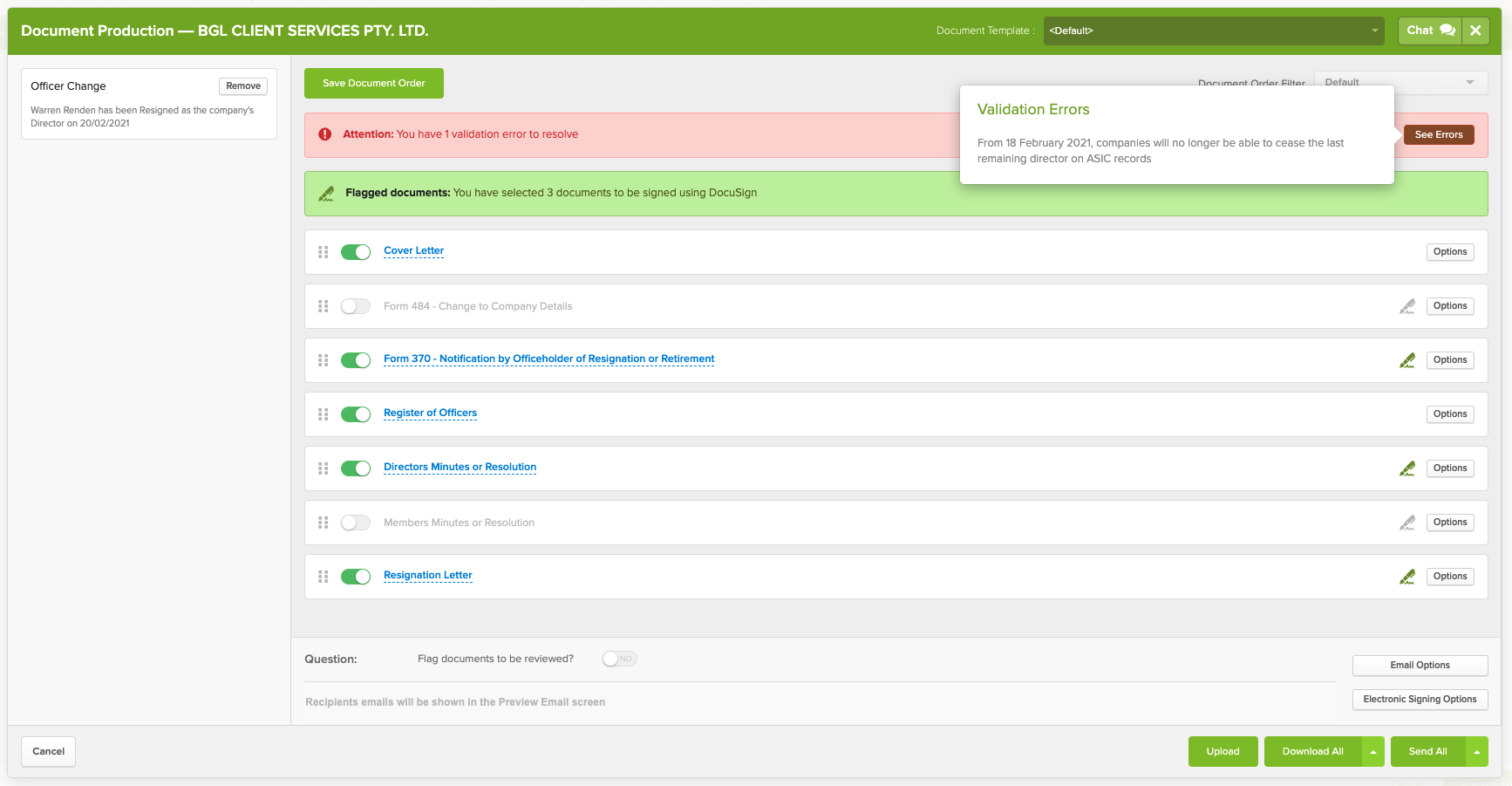

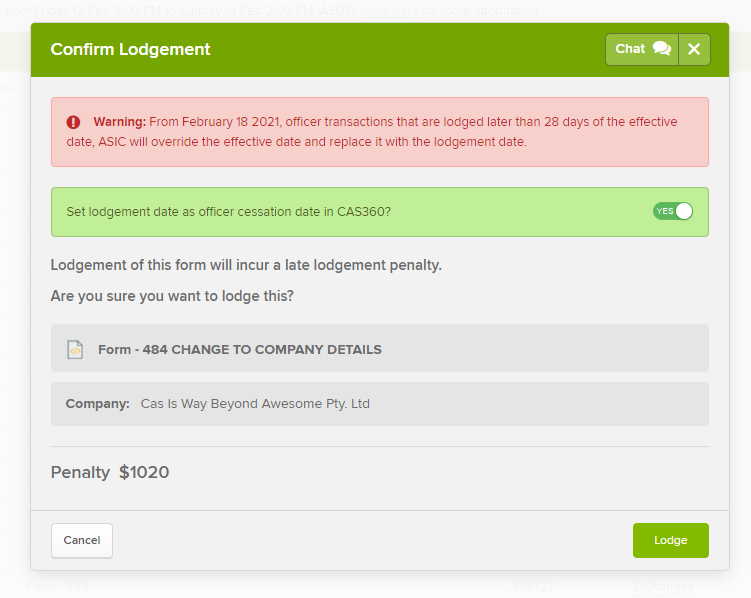

We deeply embed the digital signing solution into the software. We mark up the documents and forms, so that when you deliver a set of documents to your clients, they are ready for digital signing. We allow for easy selection of signing and tracking so users can monitor the status

When complete, we notify you and then store the document as required by the governing bodies and make it easy for you to retrieve.

When it comes to Digital Signing solutions, the end-to-end experience is so important and that is what we make great!

Recent Comments